Tax time: Learn about these new changes to U.S. taxes before you file

Two things are inevitable in life: death & taxes. Since it’s a new year in the U.S., that means tax returns are due by April 15th for most Americans and it’s nearly time to get started filing.

Granted, many U.S. citizens & residents like to file their taxes early. All over the nation, people are already calling their accountants or firing up their H&R Block & TurboTax accounts to get their returns in as soon as possible. Of course, there are the procrastinators, but with some tweaks to the tax code this year, you may not want to wait until April to get your taxes sorted.

Unfortunately, the U.S. tax code is longer than the Harry Potter series & George RR Martin’s A Song of Ice and Fire books combined. Spoiler alert: it’s way more boring to read. With the new changes, we’re breaking down what you can expect when filing your U.S. tax returns this year.

Are your stimulus checks taxable?

Good news! Your stimulus checks aren’t taxable, including both the first round of stimulus checks in March and the new upcoming one this month. However, there are a few things you should know.

Per The Wall Street Journal, the second stimulus check you’ll receive “begins to phase out at $75,000 of adjusted gross income for most single filers and $150,000 of AGI for most married joint filers. For individuals without children, the payments go to zero when income reaches $87,000, or $174,000 for couples filing jointly.” That means if you make a lot of dough, no stimulus check for you!

However, there are a few exceptions. Stimulus checks are doled out based on your 2019 tax returns. However, if you made a lot of money last year and found yourself out of a job in 2020, significantly downsizing your income, you can be eligible to receive a stimulus package. Similarly, if someone made much more than expected in 2020, The Wall Street Journal assured its readers they won’t have to give the stimulus check back.

Adjusting for inflation

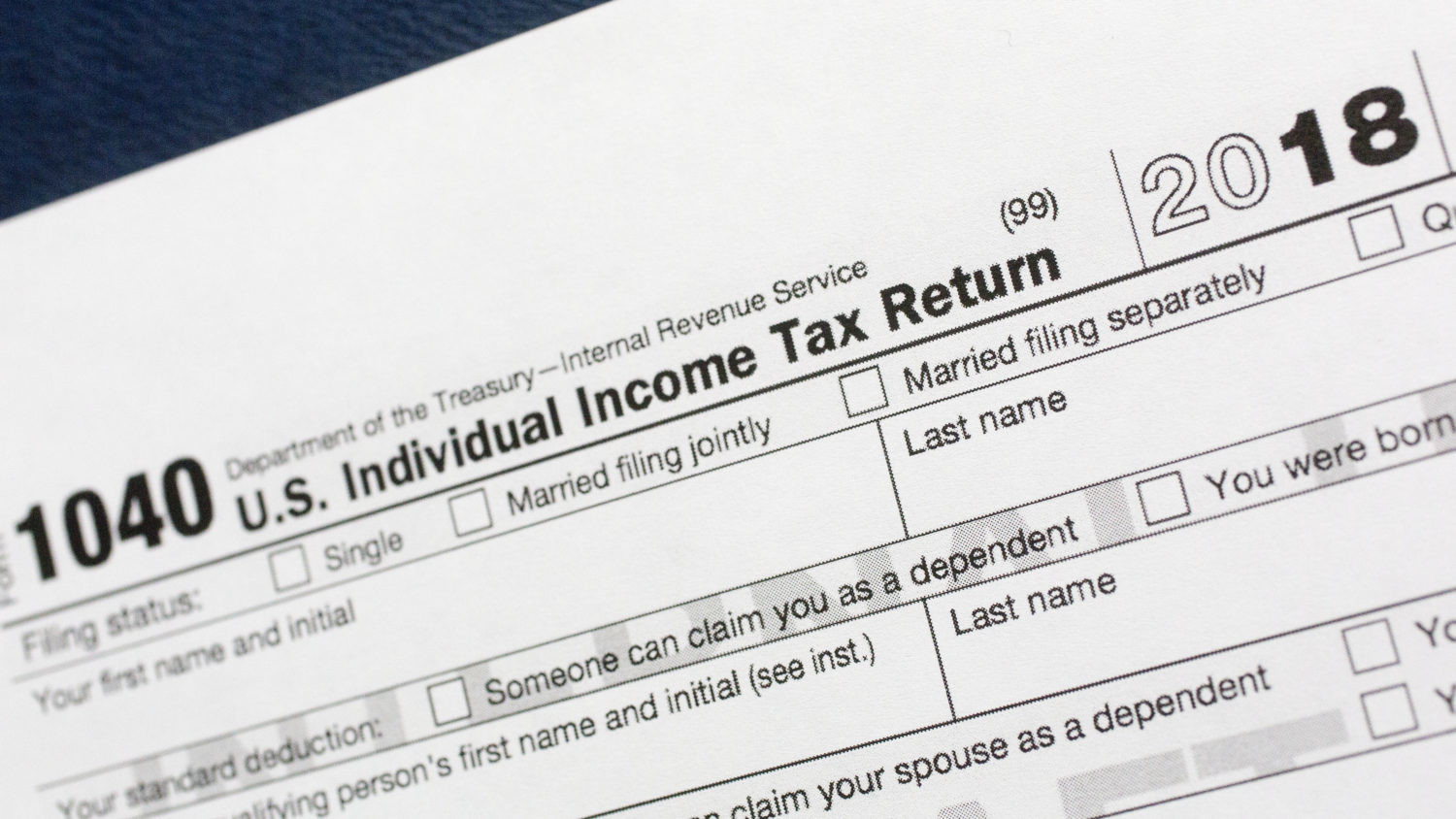

The U.S. tax code was adjusted for inflation, which is actually a good thing. The new tax brackets can help most Americans keep more money. The tax brackets now go up to 37%, but that’s only for single taxpayers & heads of households making over $510,400 and married couples who bring in over $622,050.

The average American makes a little over $35,000. Per the new tax codes, 12% of their income is taxable under the U.S. federal tax code. State taxes may vary, though.

Better deduction rates

Per CNBC, “The IRS also bumped your standard deduction for the 2020 tax year, which could reduce your taxable income.” Meaning, if you have deductions for dependents and other reasons, you can save more money and don’t have to give as much to Uncle Sam.

Per Ramsey, a money management & coaching site, “the standard deduction for 2020 increased to $12,400 for single filers and $24,800 for married couples filing jointly.” From 2019, these deductions increased just a little, by $200 for single earners and $400 for married couples filing jointly. But hey, it’s something!

Saving for retirement?

The IRS was also kind to your 401(k). They upped the limit of contributions to 401(k), 403(b), and most 417 plans from $19,000 to $19,500. “Catch-up contributions”, investments by people over fifty who need a little more in the bank before retirement, also increased by $500, as did SIMPLE retirement accounts.

However, IRA contributions (both traditional & Roth), including catch-up contributions, remain capped at the same amount for U.S. tax filing purposes in 2020.

—

Are you filing your taxes early this year, or waiting until April? Let us know in the comments!