How NFT is Changing the Art Market – Andrey Elinson

NFT technology, which has been around for roughly three years, was supposed to help artists monetize their work but ended up making their lives harder, says art critic Andrey Elinson

These days, you’ll be hard-pressed to find someone who has never heard about the type of digital money called cryptocurrency. It includes, for example, Bitcoin, Litecoin, and Ether. If you swap this cryptocurrency in equal amounts, no one loses or gains anything. It’s like exchanging one coin for another with the same monetary value.

So what is NFT? “NFT is not a cryptocurrency, but a kind of digital certificate confirming your possession of a work of art, a Twitter post, a music track, a photo collage, or some other media object. Unlike with Bitcoins, it is impossible to swap one for another: any such certificate has its own unique value. Thus, NFT is a unique digital certificate confirming the credibility of an item’s owner in the physical world. This type of ownership is not legally regulated but is already actively used,” explains art critic Andrey Elinson.

The peak of NFT’s popularity coincided with the pandemic: with people trapped inside the four walls of their houses, art fairs, auctions, galleries, and museums moved into the Internet space. The rise of the NFT is attributed to the Clubhouse app, which went out as quickly as it caught fire. The app users actively discussed new technologies, including NFT. In addition, the financial market was experiencing a boom, and cryptocurrency prices were soaring. All these factors contributed to the popularization of NFT technology, explains art critic Andrey Elinson.

Why pay money for something you can download from the Internet? To draw an analogy, it would be the same as downloading or buying a reproduction of the Mona Lisa. Its original will, in any case, be incomparably more valuable, and in the case of NFT, the buyer of the media object becomes its owner.

How is NFT changing the way things are sold in the art market? Art creators and connoisseurs are given more power than ever because digital assets created using NFT are unique and unrepeatable, reasons Andrey Elinson.

“On the one hand, art is becoming more popular, more accessible, and more widespread because now you always have the purchased art object on your phone. Whereas in the past, artworks were evaluated based on the artist’s skill, school, name, the percentage of the painting drawn by the artist himself, the idea behind the artwork, and the thought the artist wanted to convey, these days, the focus is shifting to the buyer’s sense of ownership of the art object,” says Andrey Elinson.

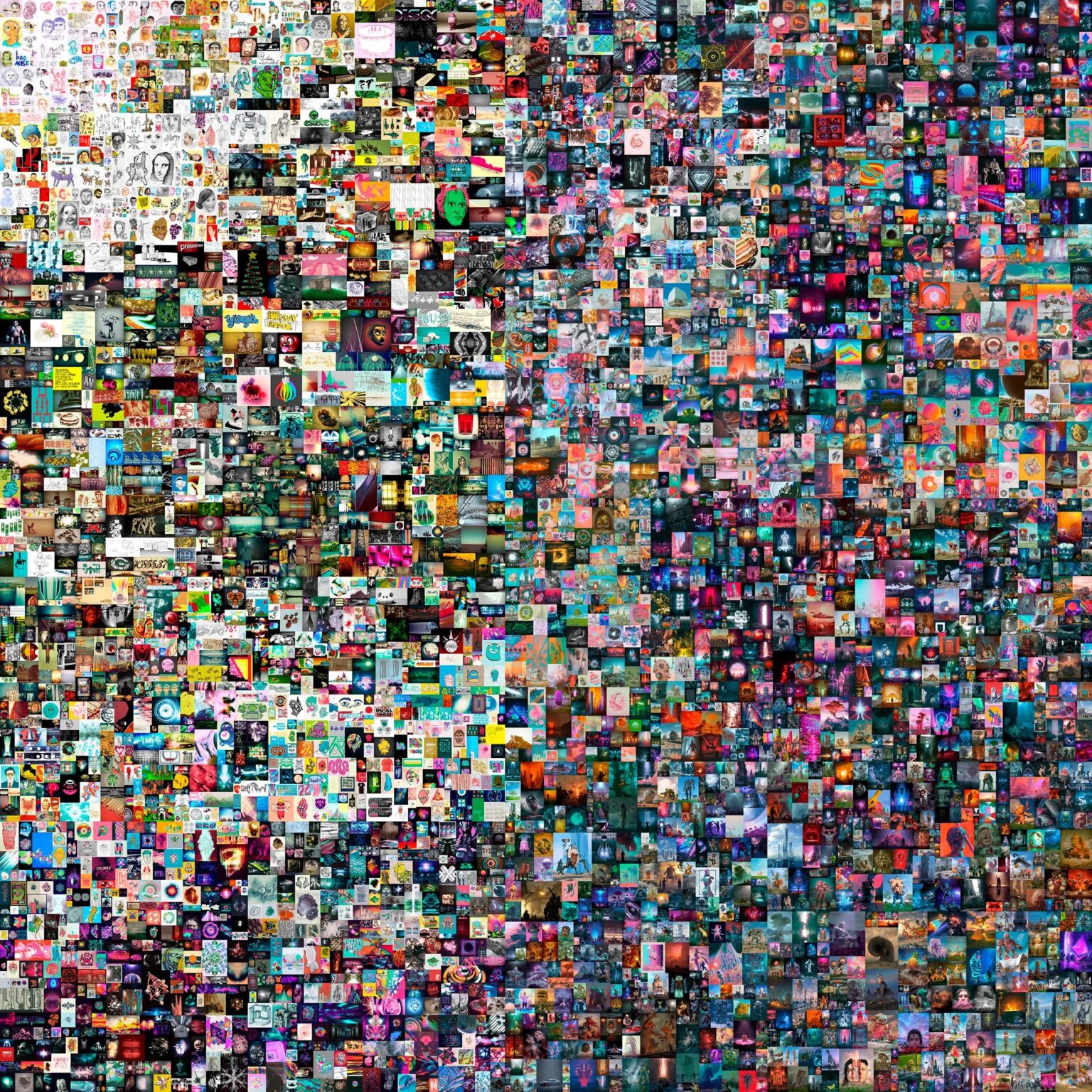

One of the most expensive deals in the digital art market took place in February 2021 in the United States. American graphic designer Mike Winkelmann (aka Beeple) sold his painting The First 5,000 Days as an NFT at Christie’s for $69.3 million. The painting has never existed in a material form. This case is considered the first-ever sale by a major auction house of a work of art that exists only in digital format. The digital version was easy to copy, but ownership was reserved for the buyer. Mike Winkelmann’s painting is a collage of 5,000 images he created daily for over thirteen years. The painting The First 5,000 Days made the graphic designer one of the most expensive living artists. It should be noted that, in this case, the artist has a fee linked to sales: that is, the author will receive 10% of the amount each time the object changes hands after the initial sale, explains art critic Andrey Elinson.

You can sell truly unique items on the crypto market. For example, in March 2021, Twitter CEO Jack Dorsey sold his first tweet as an NFT at a digital auction for $2.5 million. Another example would be the U.S. magazine Forbes selling its NFT cover in April 2021. The final price was much more modest than Jack Dorsey’s tweet: only $333,000.

One of the most high-profile cases of turning art into a virtual archive is associated with the U.S. company Injective Protocol, which specializes in blockchain technology and cryptocurrencies. The company bought one of Banksy’s works from a gallery for $95,000, digitized it, turned it into an NFT, and then demonstratively burned the original on a live broadcast. Banksy himself didn’t take part in the controversial stunt but was aware that his work would only exist in digital format. The NFT was later sold at auction for about $400,000.

According to Andrey Elinson, NFT technology has opened up new possibilities for artists. They can now easily prove the authorship of their works, sell them at online marketplaces, and then get royalties from resales if the NFT code provides for it. In addition, creators can now make several copies of the same work, each with a verified certificate of uniqueness.

“The future of NFTs is extremely difficult to predict. However, we still have no laws governing authors’ rights in the blockchain space, which occasionally leads to theft, counterfeiting, the disappearance of purchased files, and much more. Some of the problems can be avoided by using file systems from which works can’t be deleted, but not all artists do that,” says Andrey Elinson. “Hence, authors can resell works multiple times by simply assigning different NFTs to them. Works can also get stolen by criminals, copied, and resold. We see new fraud schemes appearing every day. As a result, the technology created to help artists monetize their work has made both their and the buyers’ lives more difficult.”

Andrey Elinson believes that the NFT market will not replace the art market in its traditional sense and will become just one of its segments. It is possible that NFT will evolve into a rapidly changing and risky yet immensely fascinating and attractive offshoot of the contemporary art market.