Are ridiculous Robinhood fees responsible for a man’s suicide?

The parents of a 20-year-old who died by suicide last year are suing the trading app Robinhood for what they say is their son’s wrongful death. Alex Kearns died by suicide in June 2020 after he was led to believe he owed more than $730,000 after making some risky trades, court documents, obtained by People, say.

The note found on his computer by his parents on June 12, 2020, asked a simple question. “How was a 20 year old with no income able to get assigned almost a million dollars worth of leverage?” The tragic message was written by Alexander E. Kearns, a 20-year-old student at the University of Nebraska, home from college and living with his parents in Naperville, Illinois.

Seriously sad service

According to the lawsuit, Alex was sent an email demanding immediate action asking for a minimum deposit payment of more than $170,000, and when the college student attempted to reach customer service, he was unsuccessful.

“I was incorrectly assigned more money than I should have, my bought puts should have covered the puts I sold. Could someone please look into this?” the college student wrote in one of several emails to Robinhood seeking help. According to the suit, all he received was an automated email saying the support team would get back to him “as soon as possible, but that our response time to you may be delayed”.

“He thought he blew up his life. He thought he screwed up beyond repair,” Alex’s dad, Dan Kearns, said in an interview with CBS News. Tragically, the day after Alex took his own life, Robinhood finally returned his email — and it turned out that he didn’t owe any money at all.

Ignominious irony

“Great news!” the email — another automated message — said. “We’re reaching out to confirm that you’ve met your margin call and we’ve lifted your trade restrictions. If you have any questions about your margin call, please feel free to reach out. We’re happy to help!”

“It haunts me. It really does,” Dan said, adding that he believes Alex would still be alive if he had only received a prompt answer from the company.

“I lost the love of my life. I miss him more than anything,” Alex’s mother, Dorothy Kearns, told CBS News. “I can’t tell you how incredibly painful it is. It’s the kind of pain that I don’t think should be humanly possible for a parent to overcome.”

Pandemic puttering

Like so many others, Alex took up stock investing during the pandemic, signing up with Millennial-focused brokerage firm Robinhood, which offers commission-free trading, a fun and easy-to-use mobile app and even awards new customers free shares of stock. During the first quarter of 2020, Robinhood added a record 3 million new accounts to its platform.

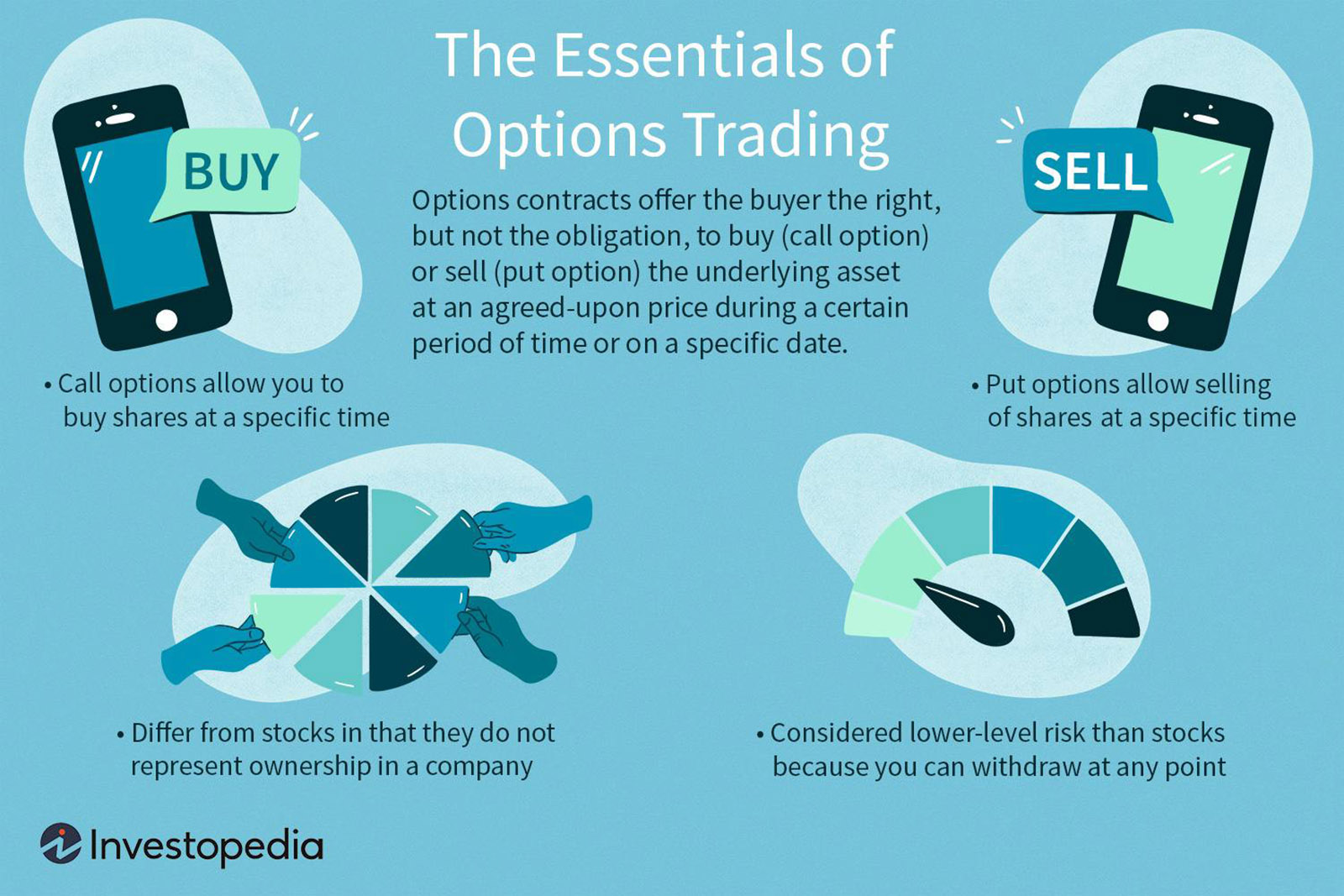

As the pandemic stock market swung wildly, Alex had begun experimenting, trading options. His final note, filled with anger toward Robinhood, says that he had “no clue” what he was doing.

I saw @RobinhoodApp response and can confirm they did reach out. The family isn’t ready to speak yet. Since they can’t release account details here’s the screenshot. pic.twitter.com/uqeDhro7aJ

— Bill Brewster (@BillBrewsterSCG) June 16, 2020

According to Forbes, a screenshot from Kearns’ mobile phone reveals that while his account had a negative $730,165 cash balance displayed in red, it may not have represented unsecured debt at all, but rather his temporary balance until the stocks underlying his assigned options actually settled into his account.

Kearns may not have realized that the negative cash balance displayed on his Robinhood home screen was only temporary and would be corrected once the underlying stock was credited to his account. Indeed it’s not uncommon for cash and buying power to display negative after the first half of options are processed but before the second options are exercised—even if the portfolio remains positive.

Inveigling the inexperienced

The suit filed by Kearns’ parents alleges Robinhood uses “aggressive tactics & strategy to lure inexperienced and unsophisticated investors” — including Alex. The complaint says Alex was allowed to invest far above his experience level and was provided with “almost no investment guidance, and its customer ‘service’ was virtually non-existent, consisting of automated email replies devoid of any human contact or interaction”.

“Tragically, Robinhood’s communications were completely misleading, because, in reality, Alex did not owe any money,” the complaint says. “He held options in his account that more than covered his obligation, and the massive negative balance would have been erased by the exercise and settlement of the puts he held.”

While some changes have been made to Robinhood since Alex’s death, including giving certain users the ability to request a call, there is still not a readily available customer service number for Robinhood users to reach out themselves, “How are those guardrails? How does that — how does that stop an 18-year-old from making risky trades that they don’t really understand?” Dan said in his CBS News interview.

_

If you or someone you know is thinking about suicide, please call the National Suicide Prevention Lifeline at 800-273-TALK (8255) or text the Crisis Text Line at 741-741.