Optimizing ETF Portfolios with the Efficient Frontier: A Comprehensive Guide

In the intricate world of investment, the quest for optimal portfolio performance is never-ending. Portfolio optimization, a cornerstone of modern finance, seeks to maximize returns for a given level of risk. Central to this endeavor is the concept of the “Efficient Frontier.” This guide delves deep into the Efficient Frontier, its significance in modern portfolio management, and its application in optimizing ETF portfolios.

Understanding the Efficient Frontier

Definition and Historical Context:

The Efficient Frontier is a captivating concept in the realm of finance and investment. At its core, it represents a set of portfolios that, for a specified level of risk, provide the highest possible expected return. This means that for every point on the Efficient Frontier, there isn’t a portfolio that offers a higher expected return without taking on more risk.

The origins of the Efficient Frontier trace back to the 1950s, with the pioneering work of Dr. Harry Markowitz. His groundbreaking research culminated in what is now known as the Modern Portfolio Theory (MPT). MPT introduced the idea that investors can achieve optimal portfolios by considering the relationship between risk and return. This was a revolutionary shift from the traditional focus on individual asset returns to a more holistic view of portfolio returns as a whole. Over the decades, Markowitz’s insights have been widely recognized, earning him the Nobel Prize in Economic Sciences in 1990. Today, the Efficient Frontier stands as a testament to his contributions, serving as a fundamental tool for investors across the globe.

The Concept of Risk and Return Trade-off:

Investing is as much an art as it is a science. At the heart of this discipline lies the delicate balance between risk and return. Every investment opportunity presents a potential reward, but this comes with inherent risks. Some investments might offer high returns but come with a high level of volatility, while others might be more stable but offer modest returns.

The Efficient Frontier brings clarity to this intricate dance between risk and return. It provides a visual representation of the trade-offs investors face. By plotting portfolios on a graph based on their expected returns and associated risks, the Efficient Frontier helps investors identify which portfolios offer the best returns for a given level of risk. This invaluable insight empowers investors to make informed decisions, ensuring that their investment choices align seamlessly with their risk appetite and financial goals.

Visualization of the Efficient Frontier:

To truly grasp the essence of the Efficient Frontier, one must visualize it. Picture a graph where the horizontal x-axis denotes risk, typically measured by standard deviation or volatility, and the vertical y-axis signifies expected return. As you plot various portfolios based on their risk and return profiles, a pattern emerges. The portfolios that lie on the upper edge of this cluster, forming an upward-sloping curve, represent the Efficient Frontier.

This curve is of paramount importance. Any portfolio that resides on this curve is considered “efficient” because it offers the highest return for its level of risk. Conversely, portfolios that lie below the curve are “inefficient” as they provide lower returns for the same level of risk. By visualizing the Efficient Frontier, investors can easily discern which portfolios are optimal and which ones might require reconsideration. This visual tool, thus, becomes an indispensable guide in the quest for investment excellence.

Basics of ETFs: Diversification Made Simple

What are ETFs?

Exchange Traded Funds, commonly known as ETFs, have emerged as one of the most innovative and popular financial instruments in recent decades. At their core, ETFs are investment funds that are designed to be traded on stock exchanges, much like individual stocks. This unique structure combines the diversified exposure of mutual funds with the tradability of individual stocks.

One of the standout features of ETFs is their ability to offer a wide array of advantages to both novice and seasoned investors. Firstly, they provide unparalleled liquidity. This means that investors can easily buy or sell ETF shares throughout the trading day at market-determined prices, just as they would with individual stocks. This flexibility is often contrasted with traditional mutual funds, which can only be traded at the end of the trading day based on the fund’s net asset value.

Furthermore, ETFs are celebrated for their cost-effectiveness. They often come with lower expense ratios compared to traditional mutual funds, making them an attractive option for cost-conscious investors. This cost advantage can be attributed to their “passive” management style, as many ETFs aim to replicate the performance of a specific index rather than actively trying to outperform it.

The Role of Diversification:

The age-old adage, “Don’t put all your eggs in one basket,” rings especially true in the world of investing. Diversification is this principle put into practice. It involves spreading investments across a wide variety of assets or asset classes to reduce the impact of any single asset’s poor performance on the overall portfolio.

ETFs are inherently designed to offer diversification. Each ETF holds a collection or a basket of assets, be it stocks, bonds, or other securities. This means that when an investor buys a share of an ETF, they are, in essence, investing in a small portion of all the assets held by that ETF. This pooled approach allows investors to achieve diversification with a single transaction, mitigating the risk associated with individual securities. For instance, if one company within an ETF underperforms, its negative impact might be cushioned by the better performance of other companies within the same ETF.

How ETFs Span a Broad Spectrum of Asset Classes:

One of the most commendable attributes of ETFs is their versatility. They are not confined to tracking just one type of asset or sector. Instead, the ETF universe spans a broad spectrum of asset classes, offering investors a smorgasbord of options.

Whether an investor is interested in equities from emerging markets, government bonds from developed economies, commodities like gold or oil, or even real estate investment trusts, there’s likely an ETF that caters to that interest. This vast coverage allows investors to tailor their portfolios to align with their specific investment goals, risk tolerance, and market outlook. For instance, an investor bullish on the technology sector can invest in a tech-focused ETF, while another seeking stable income might opt for an ETF that tracks high-dividend-paying stocks. Additionally, understanding the differences between ETFs, such as spy vs qqq, can provide further insights into making informed decisions.

In essence, ETFs provide a gateway to the world’s markets, enabling investors to craft diversified portfolios that reflect their aspirations, beliefs, and risk appetites.

Building an ETF Portfolio: Steps and Considerations

The Importance of Asset Allocation:

Asset allocation stands as one of the most crucial decisions in the investment process. It involves strategically dividing an investor’s portfolio among various asset classes such as equities, bonds, commodities, and real estate. The primary goal of asset allocation is to create a balance that aligns with an investor’s specific goals, risk tolerance, and investment horizon.

Research has consistently shown that the majority of a portfolio’s performance variability can be attributed to asset allocation rather than the individual security selections or market timing. This underscores its significance. A well-thought-out asset allocation can help investors maximize returns while minimizing risks. For instance, while equities might offer higher potential returns, they come with higher volatility. Bonds, on the other hand, might provide stability but with potentially lower returns. By determining the right mix of these assets, investors can achieve a desired risk-return profile that resonates with their financial objectives.

Selecting the Right Mix of ETFs:

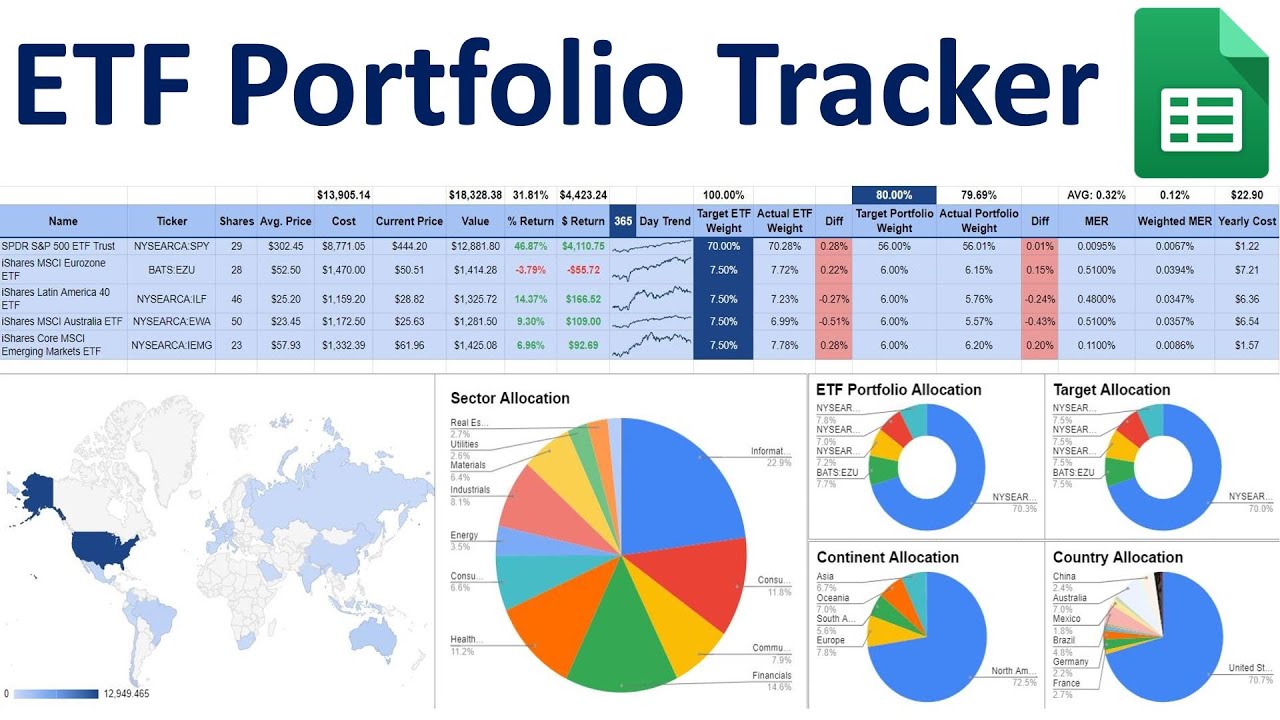

With the vast array of ETFs available in the market, selecting the right mix can seem daunting. However, the key lies in aligning the choice of ETFs with individual investment goals. Each ETF offers exposure to a specific market, sector, or asset class. Therefore, understanding the underlying assets or indices that an ETF tracks is paramount.

For instance, an investor looking for growth might lean towards ETFs that focus on emerging markets or specific sectors like technology. Conversely, someone seeking income might be drawn to ETFs that track dividend-paying stocks or corporate bonds. Additionally, considering factors like the ETF’s expense ratio, liquidity, and tracking error can further refine the selection process. In essence, the right mix of ETFs should reflect an investor’s objectives, time horizon, and risk appetite, offering a holistic approach to achieving their financial goals.

Periodic Rebalancing and Its Significance:

The financial markets are dynamic, with asset values fluctuating based on a myriad of factors ranging from economic data to geopolitical events. Over time, these fluctuations can cause a portfolio’s actual asset allocation to deviate from its target allocation. For instance, a strong performing asset class might come to represent a larger portion of a portfolio than initially intended, potentially altering the portfolio’s risk profile.

This is where the concept of periodic rebalancing comes into play. Rebalancing involves adjusting the portfolio by selling overrepresented assets and buying underrepresented ones to realign with the target asset allocation. This practice not only ensures that the portfolio remains consistent with the investor’s risk-return objectives but also provides an opportunity to lock in gains from high-performing assets and reinvest in assets that might be poised for future growth.

Applying the Efficient Frontier to ETF Portfolios

In the realm of modern finance, the Efficient Frontier stands as a beacon, guiding investors towards optimal portfolio decisions. Especially when it comes to ETF portfolios, understanding and applying the principles of the Efficient Frontier can be transformative.

How to Plot ETFs on the Efficient Frontier:

The first step in this journey involves analyzing the returns and volatilities of various ETFs. By gathering data on past performances and assessing the inherent risks associated with each ETF, investors can plot these funds on a graph. This graph, representing the Efficient Frontier, showcases portfolios that offer the highest expected return for a specific level of risk. By visualizing this, investors can easily identify the optimal mix of ETFs that align with their investment goals and risk tolerance.

Using Optimization Techniques:

Beyond mere visualization, the real power of the Efficient Frontier lies in its optimization capabilities. By leveraging sophisticated mathematical models and algorithms, investors can harness the concept of the Efficient Frontier to pinpoint the best mix of ETFs. This mix aims to maximize potential returns while adhering to a predetermined risk level. In essence, it’s about finding that sweet spot where the return on investment is maximized for the level of risk an investor is willing to take.

The Role of Technology and Software:

The digital revolution has significantly bolstered the capabilities of investors. Today, a myriad of software tools and platforms exist to simplify and enhance the portfolio optimization process. Among these tools, “efficient frontier calculators” stand out, offering investors a streamlined way to apply the principles of the Efficient Frontier to their portfolios.

In this context, it’s worth noting the contributions of platforms like ETF Insider. Not only does ETF Insider provide an efficient frontier calculator, but it also boasts a suite of other invaluable features tailored for the modern investor. Their correlation checker allows users to understand how different ETFs move in relation to one another, providing insights into potential diversification benefits. The overlap checker ensures that investors aren’t inadvertently overexposed to specific assets or sectors. Additionally, the portfolio builder offers a holistic approach to crafting a diversified and optimized ETF portfolio. Lastly, the ETF comparison tool empowers users to juxtapose different ETFs, assessing their merits and potential fit within a portfolio.

Challenges and Limitations

In the intricate tapestry of investment strategies, the Efficient Frontier stands out as a prominent thread. However, like all tools and theories, it comes with its own set of challenges and limitations that investors must be cognizant of.

Potential Pitfalls:

The allure of the Efficient Frontier often lies in its promise of optimal portfolio construction. However, a sole reliance on it can lead investors astray. One of the primary criticisms is its dependence on historical data. While past data provides a foundation for analysis, it’s essential to remember that the financial markets are influenced by a myriad of ever-evolving factors, from geopolitical events to technological advancements. Thus, what worked in the past might not necessarily yield the same results in the future. Relying solely on historical data to predict future performance can be a recipe for disappointment.

The Role of Human Judgment:

In an age dominated by algorithms and quantitative models, it’s easy to overlook the intrinsic value of human judgment. Quantitative models, including those underpinning the Efficient Frontier, offer valuable insights by processing vast amounts of data and identifying patterns. However, they operate within predefined parameters and can’t account for unforeseen events or nuances.

Human judgment brings to the table intuition, experience, and a deeper understanding of qualitative factors. For instance, while a model might suggest an investment based on past data, a seasoned investor might avoid it due to qualitative factors like management changes, industry shifts, or geopolitical concerns. Thus, striking a balance between data-driven insights and human intuition is pivotal in crafting a robust investment strategy.

Addressing the Limitations of Historical Data:

It’s a commonly echoed sentiment in the investment world: “Past performance is not indicative of future results.” This statement underscores the limitations of relying too heavily on historical data. While it provides a snapshot of how assets or portfolios performed under past conditions, it doesn’t account for future uncertainties.

For instance, historical data might not capture the impact of unprecedented events, like global pandemics or major technological disruptions. Investors, therefore, should approach historical data as just one piece of the puzzle. It’s essential to complement this data with forward-looking analysis, understanding of current market conditions, and insights into emerging trends and potential disruptors.

In summary, while the Efficient Frontier and associated tools offer valuable frameworks for investment decisions, they are not infallible. A holistic approach, blending quantitative analysis with human judgment and a keen awareness of the ever-changing financial landscape, is key to navigating the challenges and limitations inherent in investment strategies.

Conclusion

In the vast and intricate world of investment strategies, the Efficient Frontier stands as a beacon, illuminating the path to optimal portfolio construction. Its foundational principles, rooted in the delicate balance between risk and return, offer investors a systematic approach to maximize potential gains while managing associated risks.

Especially when navigating the multifaceted realm of ETFs, the Efficient Frontier becomes indispensable. ETFs, with their diverse range of assets and sectors, present a unique challenge and opportunity. The Efficient Frontier aids in deciphering this complexity, guiding investors towards a harmonious blend of ETFs that align with their financial goals and risk appetites.

However, it’s crucial to approach the Efficient Frontier with a balanced perspective. No tool, regardless of its sophistication or historical success, is a panacea. The financial markets are influenced by a plethora of factors, many of which are unpredictable and constantly evolving. Sole reliance on any single tool or strategy can lead to oversight and potential pitfalls.

Thus, while the Efficient Frontier serves as a valuable compass, it’s imperative for investors to complement its insights with continuous learning. The world of finance is in a perpetual state of flux, shaped by technological advancements, geopolitical shifts, economic cycles, and more. Staying updated, being adaptable, and approaching investment decisions with a blend of data-driven insights and human judgment can make all the difference.

In essence, the journey of investment is both challenging and rewarding. Armed with tools like the Efficient Frontier and fueled by a relentless quest for knowledge, investors can navigate this journey with confidence. It’s also beneficial to compare and contrast various ETFs, like voo vs ivv, to ensure a diversified portfolio. Embracing the intricacies of the financial world with an open mind, a discerning eye, and a proactive approach is the key to unlocking lasting success in the ever-evolving landscape of finance.