What are the ties between Jeffrey Epstein and J.P. Morgan Chase?

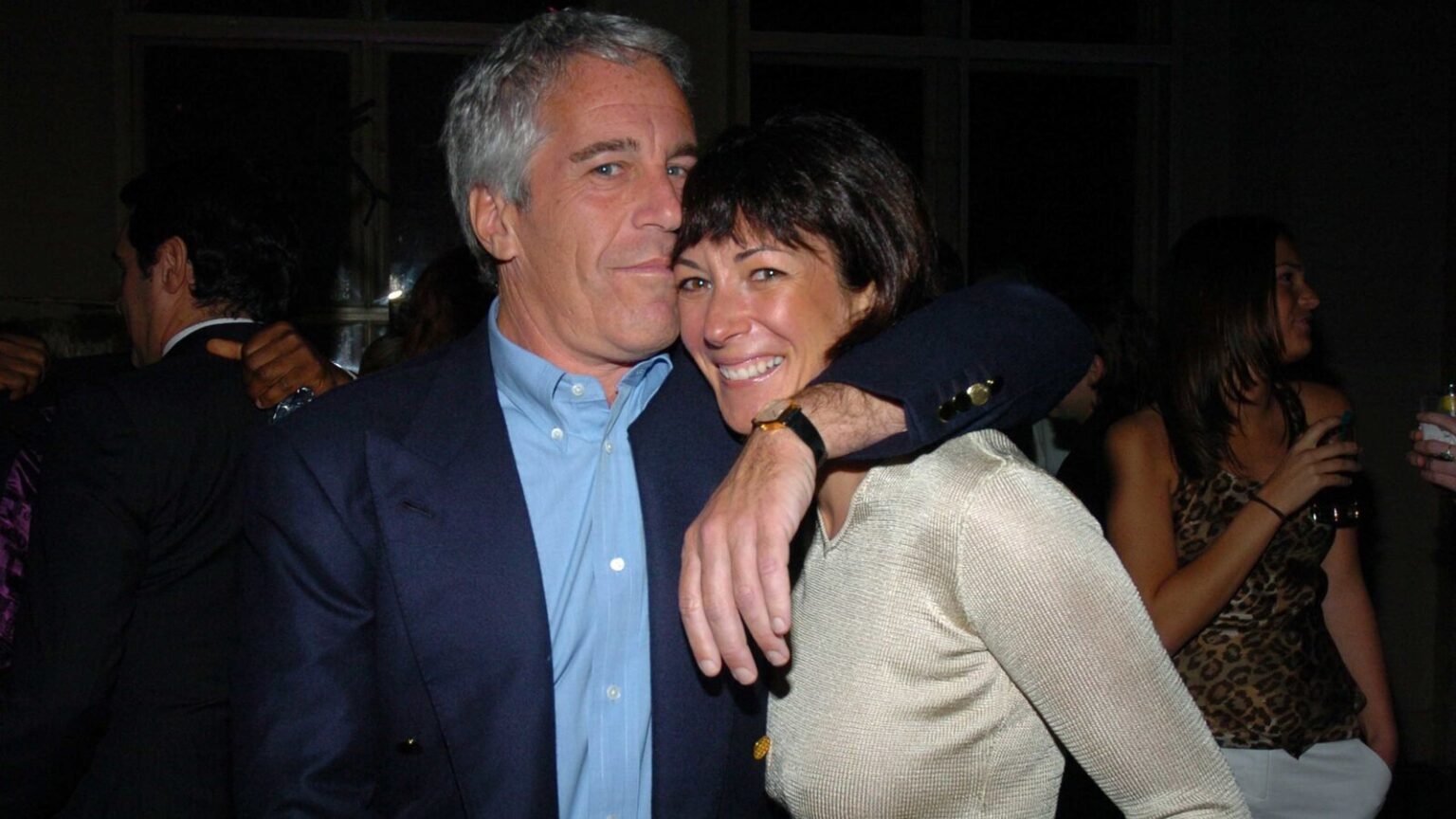

Jeffrey Epstein, a financier and convicted sex offender, and J.P. Morgan Chase, one of the world’s largest banks, have been in the news for their alleged ties.

It’s alleged that the bank processed large cash withdrawals for Epstein and his associates, despite knowing that he paid cash to have underage girls and young women brought to his home.

Let’s take a closer look at what’s been going on.

The Allegations

In recent years, several lawsuits have been filed against J.P. Morgan Chase, accusing the bank of facilitating Epstein’s alleged sex trafficking operation. These lawsuits claim that the bank ignored several internal warnings to cut ties with Epstein, and instead allowed him to access large sums of cash.

In one lawsuit, it’s claimed that Epstein pitched an “exclusive club” to J.P. Morgan Chase, with a minimum $100 million donation, and that the bank would act as the fiduciary. It’s further alleged that the bank allowed Jes Staley, a former top executive, to remain employed despite his ties to Epstein.

The Fallout

The allegations have caused significant backlash against J.P. Morgan Chase. The bank has faced calls to be held accountable for its alleged role in facilitating Epstein’s operation, with some critics arguing that the bank has not done enough to address the issue. Some have even called for the resignation of J.P. Morgan Chase CEO Jamie Dimon.

The lawsuits against J.P. Morgan Chase are ongoing, with new details emerging all the time. In April 2023, the government of the U.S. Virgin Islands filed a lawsuit alleging that the bank “turned a blind eye” to evidence that Epstein used the bank to finance his operation. The lawsuit also alleges that the bank knew about Epstein’s crimes but continued to do business with him anyway.

The Response

In response to the allegations, J.P. Morgan Chase has pledged to cooperate with the ongoing investigations. The bank has also promised to take steps to prevent similar situations from happening in the future. In a statement, the bank said: “We deeply regret our past association with Jeffrey Epstein. We are taking action to ensure that our anti-money laundering and know-your-customer policies are stricter and more effective than ever before”.

However, some critics argue that the bank has not done enough to address the issue. They point out that J.P. Morgan Chase only closed Epstein’s accounts in 2013, long after allegations of his crimes had first surfaced. Some argue that the bank should have acted sooner to cut ties with Epstein.

What Happens Next?

Will the Epstein scandal lead to lasting change in the banking industry? Only time will tell, but one thing is certain: the need for greater transparency, accountability, and ethical behavior in the world of finance has never been more urgent.

As consumers, investors, and citizens, we must all demand better from the institutions that play such a critical role in our lives. The Epstein scandal may be just one chapter in a larger story, but it has already sparked important conversations and brought attention to important issues. It is up to all of us to continue that work and ensure that the financial industry operates in a way that reflects our values and priorities.