Stable Norwegian Economy and downfall in consumer loans

Consumer Loans are going down in Norway. And it is good for the economy. Every coin has two sides, and the same goes for this consumer loan news. As consumer loan interest rates increase, exports will rise. It is good news for all associated with the trade economy in a globalized world.

In Norway, like any other country, the consumer loan interest rates directly affect the consumer loan demand and supply. Wherever there is an increase in consumer loan interest rates, consumer demand will decline. But then, there must be an increase in consumer loans as well to balance out the rise in prices of consumer goods and services.

Norges Bank has decided that the policy rate should now be increased from 0.25 percent to 0.50 percent. And the timing can also make a big difference in how much businesses will benefit from this decision.

This decision will help avoid overheating of the Norwegian economy and prevent it from getting into a debt bubble situation like other countries such as Germany and China have been facing in recent years due to increased credit expansion and excessive lending by banks chasing profits without looking at fundamentals.

What is the importance of consumer loans?

A consumer loan is a debt instrument where you pay back the principal amount and interest over a period not exceeding five years. Loans of this kind usually have lower interest rates than other types. They are said to be safer than credit cards as there is an income verification process that determines the amount one can borrow and monthly repayment options.

Consolidating all your smaller debts into a single loan reduces the number of payments each month and simplifies your finances. You can also use this loan to make home improvements, buy furniture, or go on a vacation. You will be required to pay back the entire principal amount and interest within a fixed period (usually 3-5 years).

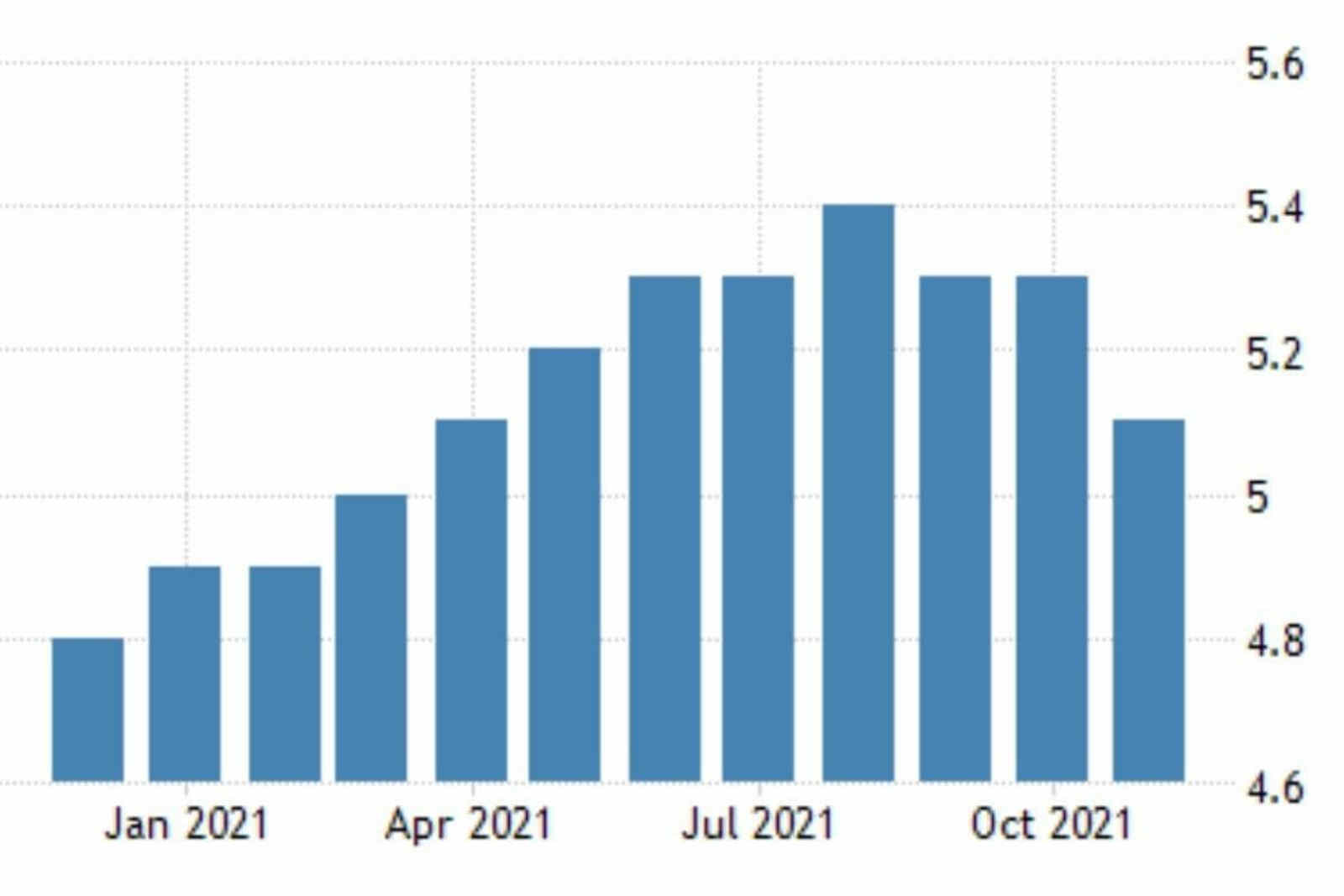

Increase in Norwegian Consumer Loan Index

The Norwegian consumer loan index, the main interest rate used in mortgage loans and consumer loans in general, has increased by 0.25 of a percentage point to 2.5 percent. The central bank, Norges Bank, has increased the rate after keeping it unchanged since March 2015. The interest costs on an annual loan of four million kroner, for instance, will increase by 20,000 kroner.

Due to a six-week notice period, you will not notice the effects of this increase until your monthly statement arrives from the bank. It means that your repayments will not become more expensive until near the end of next month. Banks and loan-giving firms like Lånepenger.no have the option of raising rates by more than the policy rate.

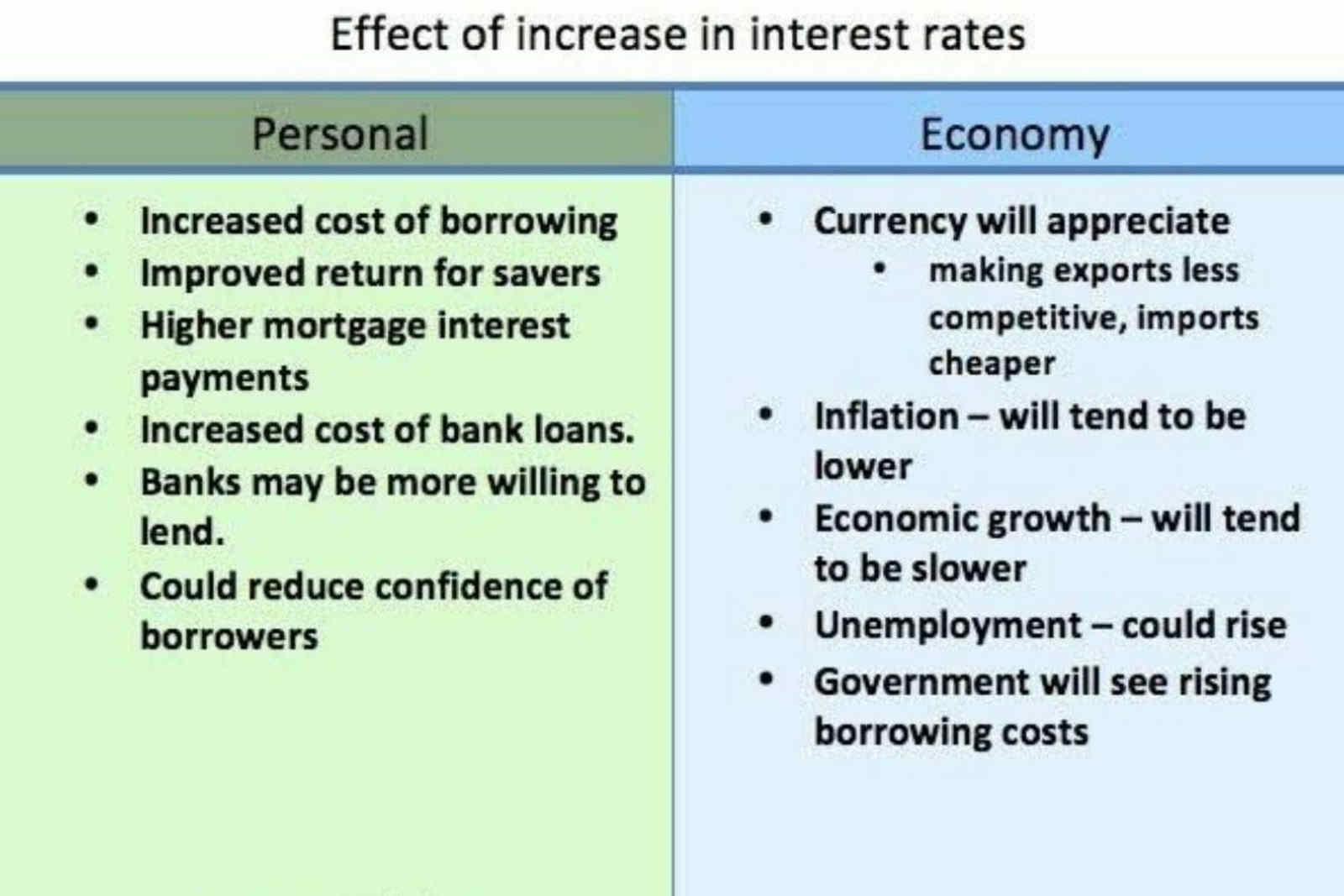

Increasing interest rates can have the advantage of reducing the purchasing power of the public, resulting in a slower rise in house prices. In spite of the fact that it is not so convenient if you want to sell up soon, it does benefit the out-of-the-market.

Why do banks increase interest rates?

As the central bank hikes interest rates, such as short-term loans and fixed mortgages, it is good for the economy. The rate hike will increase the money supply and lead to inflation. An increase in the overall amount of money increases investment opportunities for businesses and individuals.

Tightening monetary policy increases interest rates to ensure that growth is not excessive. It means that inflation should be kept in check. When inflation is not in control, it can erode the value of a currency. That makes it impossible for people to repay their debts in real terms. It leads to defaults and an economic downturn.

There are several factors other than simply interest rates that determine consumers’ borrowing costs. For example, banks also consider customers’ credit scores when deciding whether or not they can qualify for loan products with lower APRs (annual percentage rates).

Effect of Covid 19 on the economy of Norway

The outbreak has significantly affected the national economy, with many industries and sectors being hit hard by lower demand and cancellations. It is particularly apparent in tourism, travel, and agriculture, with several farms deciding to stop exporting their products after a long period of low demand.

Norway has made dietary changes in response to the decline in meat consumption that affected the agriculture sector badly. As a result of overall lower economic activity, more people were unemployed during the outbreak than before it started.

In December 2019, about 1 million persons were registered as unemployed, increasing about 12 percent compared to December 2018. This number increased to about 1 million by early December 2020, and by early January 2021, there were around 1 million unemployed persons.

The number remained stable until spring 2021 when there was a steady increase of unemployed persons in the country until summer 2021 when it reached almost 1 million unemployed persons again. In March 2020, more than 70 percent of companies had reduced employment levels due to COVID-19.

Why is the Norwegian Government increasing interest rates after the pandemic?

The Norwegian government acted because its housing market is heating up, and the bubble may be about to burst. Norway has strict capital controls that prevent its citizens from moving money abroad, so most of the house buying is financed by loans. When interest rates rise, many home buyers would find themselves unable to repay their loans.

The government also wants to prevent a repeat of the financial crisis in 2008, when banks had to write down billions of dollars of bad debts. Norway’s economy depends heavily on oil and gas, which have slumped in price since 2014. The housing bubble and rising debt levels could make it more vulnerable if the global economy slows down again or oil prices drop further.

Conclusion

After the pandemic, the companies and enterprises are in profit, and the unemployment rate is a record low in Norway. The Norwegian Central Bank has taken the step to hike the consumer loan prices resulting in low demand for consumer loans. All this is helping the state to control the escalating real estate for the first time since the Corona Virus outbreak.