What Is a Payment Gateway? How It Works and Example

A payment gateway is a crucial online service that acts as a bridge between a customers financial transaction and the merchants website, providing a secure and efficient payment process for both Businesses and Consumers. A study conducted by the Payment Card Industry Data Security Standard (PCI DSS) revealed that in 2020, global e-commerce sales amounted to a staggering $4.28 Trillion a figure that continues to grow exponentially.

Notably Payment security is of utmost concern, particularly in sectors like Forex Brokers, where the need for secure and efficient transactions is paramount. Payment gateways serve a the first line of defense, ensuring the confidentiality and integrity of financial data. Thus, understanding how payment gateways work and criteria to choose the right payment gateways in today’s digital economy and especially for Forex brokers.

What Is a Payment Gateway?

A online payment gateway is a vital online service that directly facilitates electronic transactions by securely transmitting payment information between customers and businesses. It ensures the seamless flow of funds between customers and businesses while upholding security standards.

It acts as a secure conduit that encrypts sensitive financial information, like credit card data, facilitating the authorization and settlement of online payments. The primary objective is to make electronic transactions safe, efficient, and reliable.

What is a Payment Gateway for Forex Brokers?

A Payment Gateway is a secure online service designed to facilitate and streamline financial transactions within the Forex industry. It serves as a crucial bridge connecting traders, brokers, and financial institutions. It enables traders to deposit funds, make withdrawals, and manage their margin accounts efficiently and securely.

In the fast-paced world of Forex trading, where market conditions change rapidly, a reliable Payment Gateway is of utmost importance. It ensures that transactions are executed promptly and securely, allowing traders to take advantage of market opportunities without delays. Additionally, it enhances the overall security of financial transactions, safeguarding sensitive information and bolstering trust within the Forex market.

How do payment gateways work?

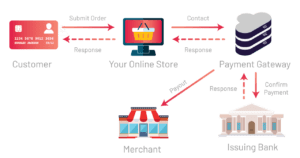

Initiating a Transaction:

When a customer initiates an online payment, such as making a purchase on an e-commerce website, they provide their payment information, such as credit Card details, on the merchants checkout page

Encryption:

The payment gateway encrypts this sensitive data converting it into a secure code to protect it from unauthorized access during Transmission.

Authorization:

The encrypted data is sent to the payment processor, which forwards it to the customer’s bank or card issuer for verification.

Response:

The bank sends an authorization (or decline) response to the payment processor, which is then relayed to the payment gateway.

Transaction Approval:

If authorized, the payment gateway notifies the merchant, and the customer’s payment is approved.

Payment Settlement:

After approval, the funds are Transferred from the customers bank to the merchants account, completing the transaction

Notification:

Both the customer and merchant receive confirmation of the successful transaction.

Example of a Forex Payment Gateway

Let’s say Trader A, based in New York, wishes to capitalize on a sudden market opportunity in the European Forex market. With their trusted Forex broker’s platform and the integrated Payment Gateway, Trader A initiates a deposit request of $10,000 USD into their trading account.

The Forex Payment Gateway swiftly processes the request, converting the USD to Euros at the current exchange rate, ensuring a competitive conversion rate. Within seconds, the funds are securely transferred to Trader A’s trading account. Subsequently, as Trader A makes profitable trades, they decide to withdraw a portion of their earnings, which is executed just as efficiently.

Throughout this entire process, the Forex Payment Gateway maintains the security and integrity of each transaction, encrypting sensitive financial data and providing real-time updates, allowing Trader A to seize market opportunities with confidence.

Why is it tough for forex brokers to find a reliable payment gateway?

This is a formidable challenge for forex brokers due to the unique demands and complexities of their industry.

Regulatory Compliance:

Forex trading is subject to stringent financial regulations worldwide. Brokers must adhere to various legal requirements, and any payment gateway they use must also comply. Navigating this regulatory landscape and ensuring that the chosen gateway meets all compliance standards can be a daunting task.

Risk Management:

Forex brokers deal with significant financial risks, including market volatility and potential fraud. A reliable payment gateway for forex must have robust risk management mechanisms to mitigate these risks effectively.

Global Operations:

Forex brokers often operate on a global scale, dealing with traders from various countries and handling multiple currencies. Finding a payment gateway that can seamlessly process transactions across borders and currencies can be challenging.

To address these challenges, white label forex broker companies like Leverate offer invaluable assistance to forex brokers. Leverate streamlines the process by connecting brokers with a curated pool of trusted payment gateway providers. By leveraging Leverate’s expertise and network, brokers can navigate the complexities of the payment processing landscape with confidence, ensuring that they have a reliable payment gateway that aligns with their specific needs and regulatory requirements. This service allows forex brokers to focus on their core trading activities while leaving the intricacies of payment processing to capable professionals.

Criteria to Choose the Forex Payment Gateway

Speed

In forex trading, every second counts. A payment gateway should offer real-time transaction processing. This means that when traders deposit or withdraw funds, the gateway should execute these transactions instantly or within a matter of seconds. Delayed processing can lead to missed trading opportunities and potential losses. Furthermore, it’s crucial to ensure that the gateway’s transaction speed aligns with the broker’s trading platform. Inconsistent timing can result in order execution problems, slippage, and ultimately affect a broker’s profitability.

Fees

The costs associated with using a particular gateway can impact a broker’s bottom line. Brokers should carefully examine the transaction fees associated with the payment gateway. This includes charges for both deposits and withdrawals. Some gateways offer competitive rates or volume-based discounts, so it’s essential to choose one that aligns with the broker’s trading volume and business model.

Additionally, brokers should assess any currency conversion fees that may apply. Forex trading involves multiple currencies, and currency conversion fees can quickly add up. Opting for a gateway with favorable exchange rates can help minimize costs.

Currency Exchange

The forex market is inherently multi-currency, requiring brokers to handle various currencies efficiently. When considering a payment gateway, brokers should look for features related to currency exchange. A suitable payment gateway should support a wide range of currencies to accommodate international traders. This ensures that traders from different parts of the world can deposit and withdraw funds in their preferred currencies, enhancing their experience.

Brokers should also consider the gateway’s exchange rates when converting funds from one currency to another. Favorable exchange rates can help brokers maximize their profits when trading in various currency pairs.

Security

Security is essential in the forex industry, where financial transactions involve large sums of money and sensitive data. A secure payment gateway should employ robust encryption protocols to safeguard sensitive customer data and financial information. Encryption ensures that all data transmitted between the trader, broker, and the gateway remains confidential and protected from unauthorized access.

Brokers should verify that the chosen payment gateway meets Payment Card Industry Data Security Standard (PCI DSS) compliance standards. PCI compliance signifies that the gateway adheres to industry best practices for data protection, providing an additional layer of security and trust for both brokers and traders

In conclusion,

A Payment Gateway is the linchpin of secure and efficient online transactions, including those in the world of Forex trading. As Forex Brokers navigate this high-speed industry, a dependable Payment Gateway becomes indispensable, ensuring the smooth flow of funds and the security of financial operations in this high-stakes environment.

Recognizing the challenges faced by Forex Brokers in finding a reliable payment

, Leverate steps in to streamline the process. Leverate offers its clients access to a carefully curated pool of trusted payment gateway providers. With Leverate’s support, Forex Brokers can connect with the right payment gateway seamlessly, fostering trust, security, and efficiency in their financial transactions.