Understanding the Benefits of Guaranteed Savings Plans

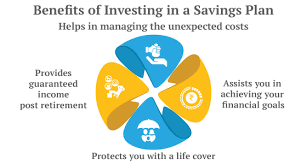

In an era marked by financial uncertainties, individuals seek security for their hard-earned money. Guaranteed savings plans have made a place by being the most reliable financial instrument that offers a unique blend of risk mitigation and growth potential. Let’s delve into the key advantages and benefits of savings plans, shedding light on why they are becoming increasingly popular among savvy investors.

- Assured Returns

What makes Guaranteed savings plans stand out is the peace of mind they bring to the table. Unlike other investments that ride the rollercoaster of market ups and downs, these plans come with a fixed interest rate or return. It’s like having a financial safety net – you know exactly what you’re getting.

Picture this: market volatility is doing its thing, but you’re chilling with your guaranteed savings plan, unaffected. It’s a solid choice for those who prioritize holding onto their capital. The predictability is the star of the show here, making it a go-to for anyone who wants a smooth ride without the financial rollercoaster drama.

- Risk Mitigation

Think of a guaranteed savings plan as a shield against the unpredictable dance of returns. The guarantees woven into these plans. They’re like a financial safety net, standing guard against the tumultuous effects of market downturns. This particular trait turns the heads of those who aren’t exactly thrill-seekers when it comes to risk – hello, risk-averse individuals and those eyeing the golden days of retirement.

It’s like having a reliable guardian for your financial fortress. Market fluctuations may be part of the game, but with guaranteed savings plans, you’re equipped to weather the storms with confidence that resonates with those who approach the financial landscape with a prudent mindset.

- Systematic Savings

Guaranteed savings plans often involve regular contributions, fostering a disciplined approach to savings. It’s not just about the numbers; it’s about cultivating a habit of financial prudence. This structured saving method becomes a beacon, guiding individuals toward achieving their financial goals and instilling a deep sense of financial responsibility.

This isn’t just a financial strategy; it’s a journey towards financial empowerment. The rhythm of regular contributions becomes the melody of financial discipline, creating a symphony that resonates with those seeking a methodical and responsible approach to securing their financial future.

- Tax Benefits:

Let’s unravel the tax benefits of savings plans — consider it the icing on the financial cake. Depending on where you’re situated and the specifics of the plan you choose, there’s a chance you might find yourself on the receiving end of some attractive tax perks.

It’s like having a financial superhero—tax advantages can kick in on contributions, returns, or withdrawals. Now, who doesn’t love a good tax break? This tax-friendly nature transforms guaranteed savings plans into not just a financial choice but a tax-efficient one.

Think of it as a savvy move for those aiming to optimize their tax landscape. It’s like putting your money to work not just for your future but also smartly managing your tax liabilities along the way. So, if you’re eyeing a financial strategy that’s not just effective but also tax-savvy, guaranteed savings plans might just be your golden ticket.

- Flexibility in Terms:

It’s a bit like having a menu of options where you pick what suits your appetite. This adaptability factor ensures that the plan isn’t just a financial tool; it’s a custom-fit solution that aligns seamlessly with an investor’s specific needs and preferences.

So, you’re not just investing; you’re crafting an investment that dances to your financial tune. Whether you’re eyeing short-term gains or playing the long game, savings plans let you call the shots, making the journey toward your financial aspirations as personalized and adaptable as it gets.

Conclusion

Guaranteed savings plans stand as a beacon of financial stability in a dynamic and sometimes unpredictable economic landscape. The combination of assured returns, risk mitigation, systematic savings, tax benefits, flexibility, and peace of mind make these plans attractive to a wide range of investors. As individuals increasingly prioritize financial security, guaranteed savings plans are likely to continue gaining prominence as a fundamental building block of sound financial planning.

Contact PNB MetLife for more information on the benefits of Guaranteed savings plans.