Is “Wolf of Wall Street” the best movie about Finance?

Despite its reputation for immoral and unlawful practices, the financial industry maintains a persistent moral stigma. However, ethical failures in the financial sector are not necessarily the result of malice. Rather, the difficulty of connecting theories and conceptual models to the “actual world” is an issue in the study of finance and other business sciences. The use of entertainment media, such as films or novels, as case studies may help students better comprehend both the backdrop of a scenario and the human side of financial data, as well.

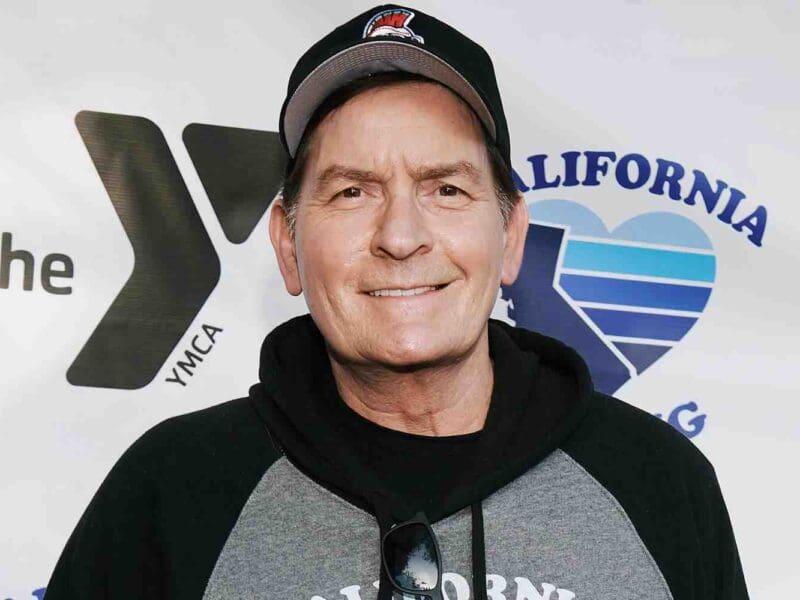

The Wolf of Wall Street is based on the actual tale of trader Jordan Belfort, who rose from obscurity to prominence on Wall Street by launching the initial public offerings (IPOs) of numerous significant firms. When Belfort’s Wall Street career takes off, this dark comedy reveals how quickly it all goes downhill and how fun it all is at the same time.

“Wolf of Wall Street” has been hailed as one of the finest movies on finance by some. This film and its narrative will be examined to see whether it can be deemed the finest financial-themed film.

Wolf Of Wall Street

Wall Street broker Jordan Belfort is shown in the film Wolf of Wall Street as one of the world’s most notorious fraudsters. As an entry-level stockbroker in a Wall Street brokerage company, where he is taught their cutthroat selling skills by director Martin Scorsese, the film begins with Belfort. He loses his job as a result of a significant market fall and is forced to work for a tiny firm that sells penny stocks. As soon as he discovered the higher commissions on penny stocks, he decided to set up his own brokerage company in order to offer them. In Wolf Of Wall Street, which is among the best financial movies, as a sophisticated businessman, Jordan establishes a corporate empire by teaching his staff how to sell effectively. Successful and wealthy, but soon realizes that success comes with a dark side, as he begins to cross ethical limits and descend into a world of crime and corruption. The financial words used in this video will now be explained in more depth, so let’s get started.

Financial Concepts

The phrase “penny stocks” is often thrown about in this movie. It is common for penny stocks to be issued by firms that don’t provide financial statements, thus they don’t trade on major stock exchanges. As a result of their low market capitalizations, prices, and trading volumes, penny stocks may trade for as little as one cent or as much as a few dollars. As an example, a rapid surge in sales or purchases might result in a price decline of more than 100 percent.

Pump and dump strategies are used by the protagonists on a regular basis, as well as penny stocks. Stock pump-and-dump strategies are described as a method of manipulating the market by amassing shares in a company’s stock or in other firms’ stock, which are then secretly kept. Cold-calling investors is then used to persuade them that these enterprises are worthy of their money. Investors would be reassured that the shares are demonstrating positive behavior as a result of the surge in demand.

Belfort learns fast while working at L.F. Rothschild, in the 1980s, that a stockbroker’s only purpose is to generate money for himself. They were more concerned with selling stocks than counseling customers on the financial risk of an investment or its fit for their portfolios, according to this report. Salespeople, not financial experts, are presented as Belfort and his crew, who are taught to sell investments at the cost of their customers. Fiduciary standards are still a contentious issue today, with some questioning whether financial professionals should be held to such a level.

What Can Investors Learn From This Movie?

It’s critical, especially for newcomers to the stock market, to have an open mind and do your own research before making any financial choices. Many of Belfort’s victims put all of their funds into ‘guaranteed’ stocks because they believed him. Even if you’re working with an adviser, it’s a good idea to learn about financial markets and tactics, possibly by starting small and diversifying your portfolio.

The financial industry is governed by legal norms, although these standards may not necessarily be ethical. In selling penny stocks, Belfort’s business complied with the law, but failing to disclose the securities’ speculative character was unethical at best. Instead of just blurring the line, Belfort went too far and was found guilty of violating securities rules after only a short time. The basis of trust and goodwill is built on ethical business practices, thus it’s critical to accept responsibility for your activities.

Despite his shortcomings as a role model, Jordan Belfort demonstrates that the route to long-term success is everything but smooth. Before he reached the pinnacle of his Wall Street career, he had both triumphs and disappointments. Due to the loss of his employment, Jordan Belfort began working as a stockbroker, and even after going bankrupt and doing time in jail, he completed his term and began working as a motivational speaker. The next step is the most crucial one a person can take.