What is the Bitcoin halving? Where can I find a chart?

Button up, buckaroos, and grab your mining hats. We’re about to delve into the digital catacombs of cryptocurrency. You’ve all heard the e-chatter, the tweets, the memes: “What the heck is a Bitcoin halving, and where can I check out a Bitcoin halving chart?” Well, hold on to your keyboards, pals, because we’re going to suss this all out. We’ll decode the mythical beast that is Bitcoin, slice and dice the logic behind its halving, and even hand you a shiny, ready-to-ogle, Bitcoin halving chart!

Decoding the halving: Airdropping you into the Bitcoin universe

First off, let’s get down to basics. This whole shebang starts with the fact that Bitcoin is like a rebellious teen – it doesn’t like too much of itself floating around. See, there’s a total of 21 million bitcoins that can ever exist. Now, every 210,000 blocks (which take about four years to write – the general block time in Bitcoin is about 10 minutes), the rewards that miners get for verifying Bitcoin transactions are halved. Hence, the term ‘halving’. It’s the division of a pizza into smaller and smaller slices so that everyone can get a piece. Makes sense, right?

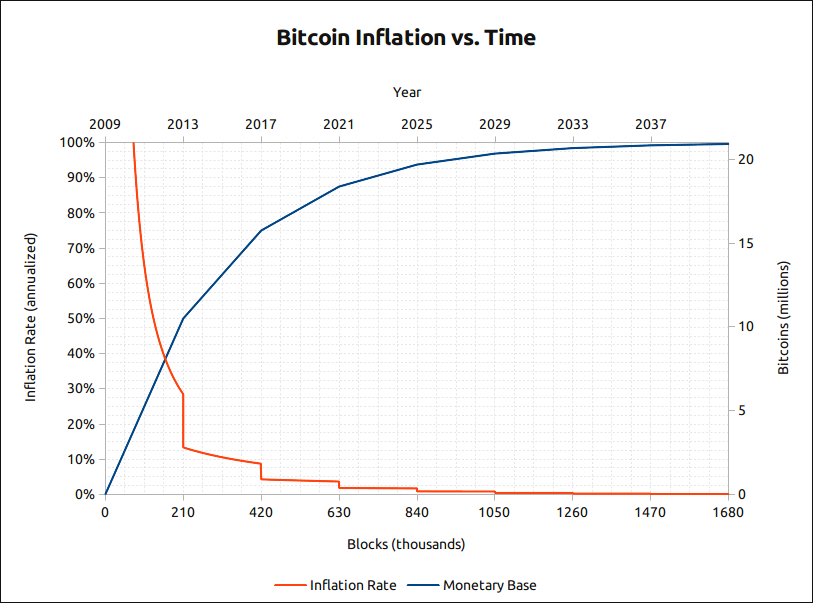

Now, winding our way back to our favorite keyword of the day, the “Bitcoin halving chart.” This snazzy little graph is your digital compass in the vast ocean of cryptocurrency. It can guide you on an adventure through the past, present, and future halvings. These charts highlight when the big halving events took place, how many bitcoins were in circulation, and what mining rewards were handed out. Basically, it’s your crystal ball into Bitcoin’s purse and can provide some nice insights into its value in the future.

Alright, enough with the jargon, let’s bring all this home. The logic behind Bitcoin halving is similar to the concept of supply and demand. The lesser the bitcoins in circulation, the more value each one holds. It’s like that limited first-press vinyl record – the fewer there are, the more you’d pay for one. The Bitcoin halving chart reaffirms this, showing us that Bitcoin, like fine wine, likes to age and get more valuable over time. So there you go, folks! Our trip into the Bitcoin black hole has come to an end. Pointers all taken, we trust you’d now do a great impression of a Bitcoin bard at your next chat on the internet of money.

Bitcoin halving: Wading through the digital gold rush

Before we start blowing your minds with all the technical mumbo jumbo, let’s lay some groundwork. Bitcoin’s innards are organized in such a way that only a certain amount of coins can ever be “mined.” Every 210,000 blocks or so, the rewards for mining are halved, limiting the number of bitcoins on the loose. As for our favorite SEO term, the glamorous “Bitcoin halving chart”, it’s basically your treasure map to all past and future halvings.

Now, let’s go spelunking through the caverns of Bitcoin. Picture the Bitcoin halving chart like an adventurer’s time machine. It transports you back to previous halving events, showing how many coins were in circulation and what the mining rewards were. It then whizzes you back to the present before forecast-blasting you into the future – usually with some pretty rosy predictions.

Here’s your golden take-home nugget: the logic behind Bitcoin halving is all about supply and demand. The fewer bitcoins up for grabs, the more those puppies are worth. Naturally, Bitcoin likes to limit its edition – think of it as the Gucci handbag of cryptocurrencies. The Bitcoin halving chart ably illustrates this, and puts a nice little bow on our journey into the cave of Bitcoin. We’ve now safely emerged, grinning wide and ready to talk Bitcoin like the pros at the watercooler. Literally.

Strapped in for the halving: Tightening your Bitcoin seatbelt

Setting the stage here, Bitcoin is like an angsty teenager rebelling against ‘too much’ of itself. It’s simply anti – “quantity over quality”. Only 21 million bitcoins can ever wiggle their way into existence. Now, every 210,000 blocks (an adventure that usually spans approximately four years), the goodies miners bag for confirming Bitcoin transactions get cut in half. Voila, you have the ‘halving’. Just imagine divvying up a pizza into tinier slices so everyone gets a bite. Pretty simple, isn’t it?

Pivoting back to our gold-star keyword, the “Bitcoin halving chart.” This little piece of digital art is nothing less than your North Star amidst the expansive crypto universe. It can time travel you through past, present, and looming halvings and spotlights times when the big halving parties happened, the count of bitcoins doing the rounds, and the rewards that were doled out to the lucky miners. In essence, it’s your magic mirror peering into Bitcoin’s wallet and hinting at its future worth.

Pulling it all together now, the philosophy fueling Bitcoin halving falls back on good ol’ supply and demand. Fewer bitcoins in play up the value for each that survives the cut. Picture it as that rare, first-edition comic book – the scarcer they are, the more you’ll shell out to snag one. The Bitcoin halving chart stands testimony to this, painting a picture of Bitcoin as the aging whisky that only gets more coveted with time. And there you have it, folks! You’ve now successfully navigated the Bitcoin vortex and, armed with these pointers, we trust you’ll smash your next cryptocurrency clique chat.

Back to the future with the Bitcoin halving chart

Back to the future with the Bitcoin halving chart

Well, folks, we’ve zigged and we’ve zagged and ended up right where we started — only now, you’re a bona fide Bitcoin whisperer, aren’t you? The Bitcoin halving chart? Oh, you can read that like your favorite dog-eared novel, discerning the underlying push-and-pull of supply and demand. The canny trick Bitcoin pulls to make itself more desirable is now fooling no one — least of all, you.

So, break out your charts, throw around your newfound Bitcoin jargon, and remember — in the world of bitcoins, less is really more. The next time the topic of digital gold comes up, just flash that Bitcoin halving chart and you’re set to talk shop, baby. Be prepared to bask in your own coolness as the Bitcoin bard you’ve now become. Happy mining, you digital prospectors – it’s a brave, new, Bitcoin-laden world out there!

Back to the future with the Bitcoin halving chart

Back to the future with the Bitcoin halving chart