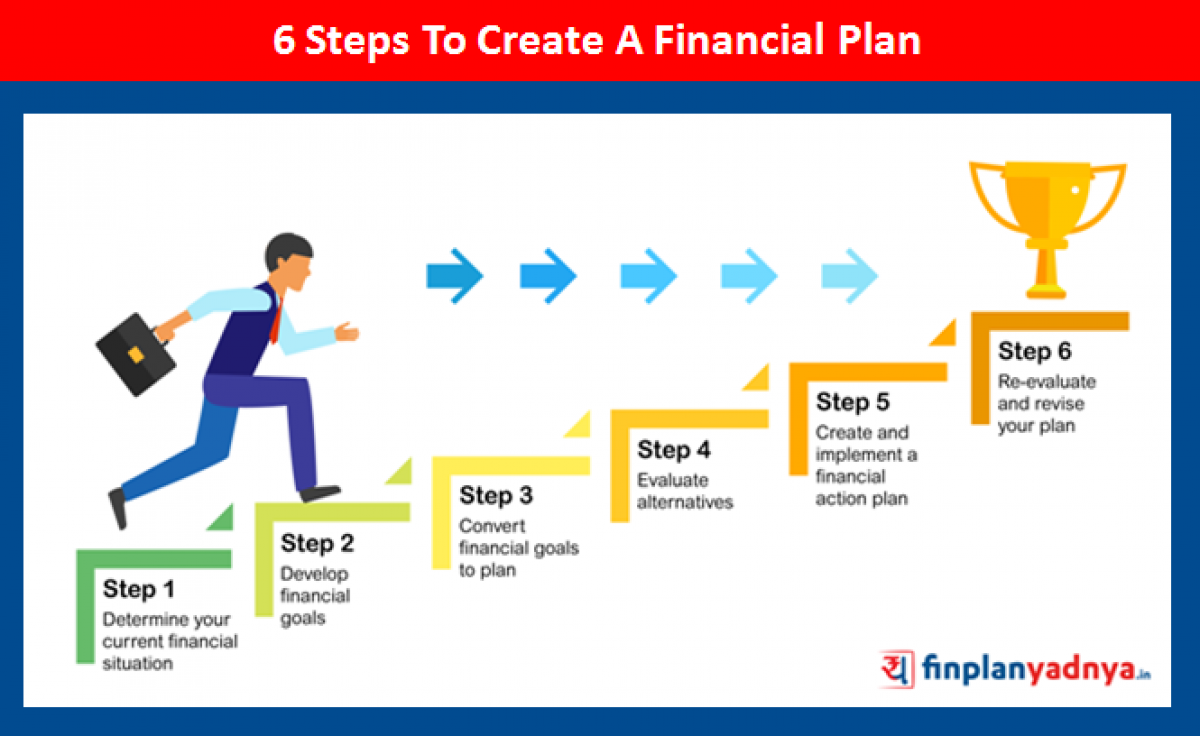

Steps to Prepare for Your Financial Future

Preparing for your financial future is a proactive and essential endeavor. Apart from your current financial situation, taking necessary steps today can help secure a brighter tomorrow. In this comprehensive guide, we’ll let you know the fundamental steps to prepare for your financial future in greater detail.

Assess Your Current Financial Situation

The first step in preparing for your financial future is to take stock of your current financial status. This involves:

Calculate Your Net Worth

Determine your net worth by subtracting your liabilities (debts) from your assets (savings, investments, and property). This figure provides an overview of your current financial standing, which is vital for making informed financial decisions.

Review Your Income and Expenses

Assess your income sources in detail, including your salary, bonuses, investments, and other sources of income. Track your expenses meticulously, categorizing them into fixed (mortgage or rent, utilities) and variable (groceries, entertainment) expenses. Creating a detailed budget will help you understand your spending habits and identify areas for potential savings.

Set Clear Financial Goals

Setting specific and achievable financial goals is the foundation of a secure financial future.

Short-Term and Long-Term Goals

Differentiate between short-term goals (e.g., building an emergency fund, paying off credit card debt) and long-term goals (e.g., retirement, homeownership). Having a mix of both provides direction and motivation. Consider setting a timeline and a monetary target for each goal.

Prioritize Your Goals

Rank your goals by importance and timeline. Prioritization ensures that you focus on what matters most to you and allocate resources accordingly. Decide which goals are immediate priorities and which can be accomplished over the long term.

Create a Realistic Budget

A well-structured budget is the cornerstone of financial planning.

Track Your Income and Expenses

Use budgeting tools or apps to monitor your income and expenditures accurately. This data will serve as a basis for informed financial decisions. Be diligent in recording all sources of income and all expenses, no matter how small they may seem.

Categorize Your Expenses

Differentiate between essential expenses (e.g., housing, utilities, groceries) and discretionary spending (e.g., dining out, entertainment). This separation helps you identify areas where you can cut back. Additionally, categorizing expenses can reveal patterns in your spending behavior.

Set Spending Limits

Establish realistic spending limits for each category within your budget. These limits will help you control your spending and direct funds toward savings and investments. Be sure to revisit your budget regularly to make necessary adjustments based on changing financial circumstances.

Reduce High-Interest Debt

Identify and Prioritize Debts

List your debts, including their interest rates and balances. Prioritize paying off high-interest debts first while making minimum payments on others. High-interest debts, like credit card debt, can drain your finances the fastest.

Debt Repayment Strategy

Consider popular strategies like the debt snowball (paying off the smallest debt first) or the debt avalanche (paying off the highest interest rate debt first) to accelerate your debt reduction. Choose the strategy that aligns with your financial psychology and motivation. If it is credit card debt, you can get the best credit card for balance transfer to transfer your balance to a new card with 0% introductory APR.

Avoid Accumulating More Debt

While paying down existing debt, be mindful of avoiding new debt. Minimize credit card usage and practice responsible spending. Create a plan to address any underlying issues that lead to accumulating debt.

Build an Emergency Fund

An emergency fund acts as a financial safety net during unexpected events.

Determine the Ideal Amount

Strive to save at least three to six months’ worth of living expenses in your emergency fund. This buffer can cover unexpected medical bills, car repairs, or job loss. Calculate your monthly expenses precisely to determine your emergency fund target.

Start Small, Save Regularly

Building an emergency fund can be gradual. Begin with a modest contribution from each paycheck, and over time, your fund will grow. Consistency is key. Automate your savings by setting up direct deposits into your emergency fund.

Buy Right Insurance Coverage

Insurance provides protection against unforeseen events.

Evaluate Insurance Needs

Determine the types of insurance you require, such as health, life, disability, property, or funeral insurance. Ensure your coverage aligns with your current circumstances. It’s essential to have adequate coverage to protect your financial well-being.

Regular Policy Reviews

Periodically review your insurance policies to make necessary adjustments. Life changes, such as marriage, having children, or buying a home, may require updates to your coverage. Keep your policies up-to-date to prevent gaps in protection.

Invest Wisely

Investing can help you grow your wealth over time.

Understand Your Risk Tolerance

Before investing, assess your risk tolerance. Different investments carry varying levels of risk, so choose assets that align with your comfort level. Consider factors such as your age, financial goals, and investment horizon.

Diversify Your Portfolio

Spread your investments across diverse asset classes, such as stocks, bonds, real estate, and even alternative investments like cryptocurrencies or precious metals. Diversification can help mitigate risk and enhance your potential returns.

Regularly Review and Adjust

Investments are not static. Periodically review and adjust your portfolio to ensure it aligns with your financial goals and risk tolerance. Consult with a financial advisor or use online tools to assess your asset allocation and rebalance as needed.

Plan for Retirement

Planning for retirement should begin early to benefit from compound interest.

Start Early

The earlier you begin saving for retirement, the more time your investments have to grow. Take advantage of employer-sponsored retirement plans, like a 401(k), and individual retirement accounts (IRAs).

Set Retirement Income Goals

Calculate your estimated retirement expenses and set a savings goal. Aim to save enough to maintain your desired lifestyle during retirement. Consider factors like inflation and potential healthcare costs in your calculations.

Conclusion

Preparing for a bright financial future is an ongoing journey that requires commitment and diligence. By following these steps, you can lay a solid foundation for a secure and prosperous financial future. Start implementing these strategies today to create the tomorrow you envision.