Everything You Need to Know About Solo & Self-Directed 401K LLCs.

A self-directed 401k, or a Solo 401k, is a savings option for business owners who do not employ anyone. The Solo 401k works similarly to the standard 401k, allowing the owner to contribute pre-tax earnings to their account and defer those taxes until the funds are withdrawn in retirement. You can also invest in a limited liability company with your 401(k). The LLC can then invest in real estate and other passive activities.

Solo 401Ks are popular among business owners because they give them more control over their funds and the ability to choose their investment plan. Furthermore, because there are so many options, investors can use alternative assets to supplement their retirement savings. Keep reading to learn more about Solo or Self-directed 401K LLCs.

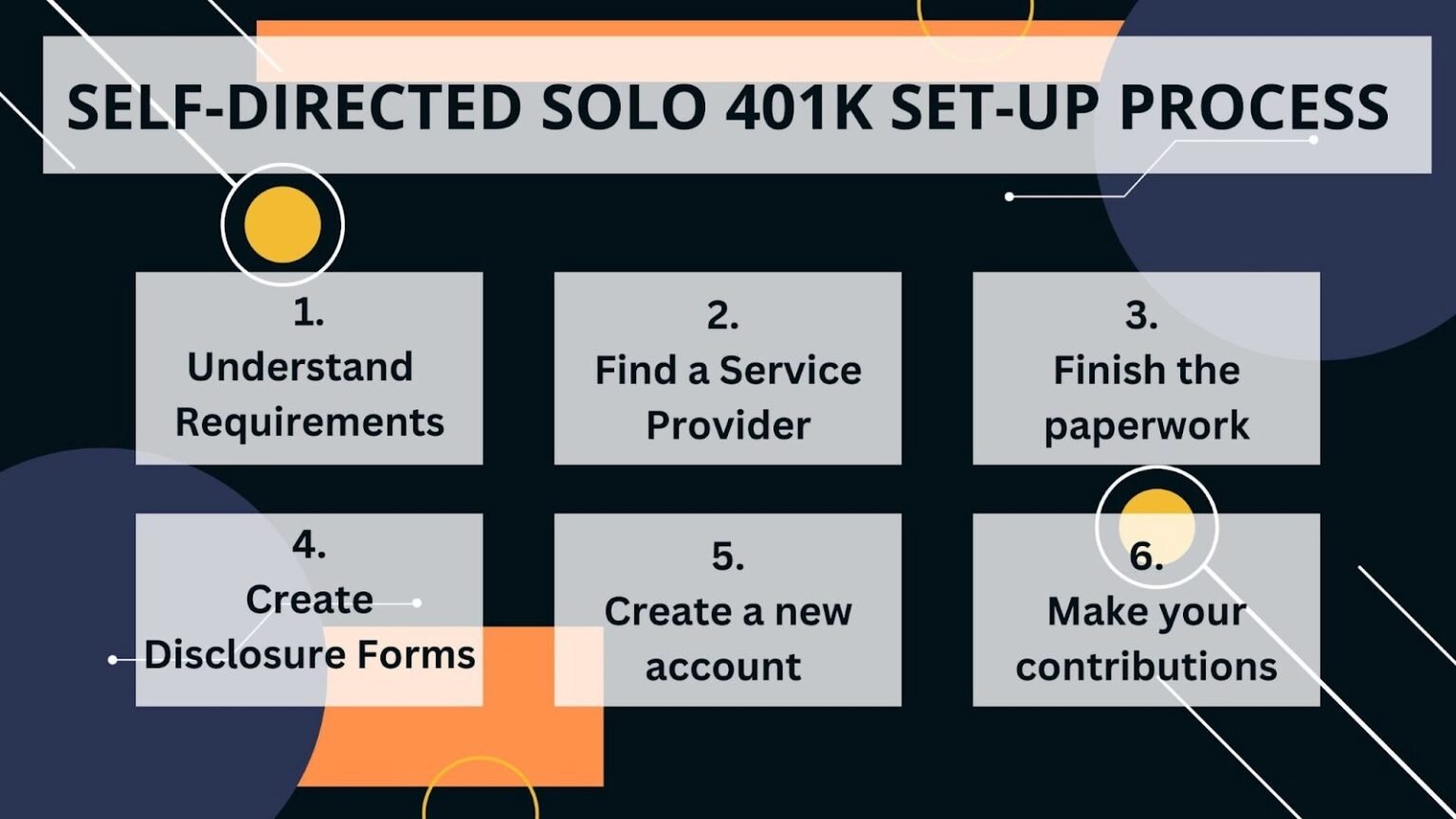

The Self-Directed Solo 401k Set-Up Process

Setting up a Solo 401K is not at all a complicated process. Here’s what you need to do:

-

Understand the Eligibility Requirements.

First, familiarize yourself with the eligibility requirements. The primary eligibility requirement is that you, as the business owner, can only participate because the plan is only designed for one participant. If you have full-time employees eligible for a 401(k), you will not be eligible for the plan (k).

2.Find a Service Provider.

Once you understand the eligibility requirements, you can find the best provider of self-directed IRA services, for example, in Wyoming. Consider moderate fees, investment flexibility, and a good reputation when shortlisting companies.

3.Finish the paperwork.

Then, with your provider’s assistance, complete the necessary paperwork. It will formalize your Solo 401(k) (k).

4.Create Employee Disclosure Forms.

Even if you do not have employees who can participate in your Solo 401(k), you must create disclosures of certain information about the plan and the benefits of tax-free savings (k).

5.Create a new account.

Then, open and set up your Solo 401(k) with your provider. Follow the guidelines outlined in the plan documents. You can open the account whenever you want before the tax deadline.

6.Make your contributions.

Finally, begin contributing once you’ve established your Solo 401(k). To make things easier, you can set up automatic, electronic contributions or make a single contribution before the end of the tax season.

Benefits of Self-Directed or Solo 401ks

-

Alternative Investment Options.

You can invest in various alternative investment assets, such as:

- Physical real estate

- Promissory notes

- Precious metals

- Tax liens, private lending, cryptocurrency, etc.

2.Increased contributions.

The contribution limit is $61,000 in 2022 or $66,000 in 2023, plus a $6,500 extra contribution for people above 50 in 2022. In 2023, the extra contribution becomes $7,500.

3.The administration process is incredibly easy.

The administration is simple and easy. While you are the plan’s trustee, the American IRA is the record keeper. At the same time, no annual taxation is required for any plan with less than $250,000 in plan assets. If the value of your plan exceeds $250,000, you must file a simple 2-page IRS Form 5500-EZ

4.Consolidation of funds is possible with the Solo 401K plans.

You can transfer IRAs, funds from previous employers, and traditional IRAs.

5.Total investment freedom.

You are accustomed to a certain amount of autonomy when you work for yourself. You can select your work hours, workspace, and clients. However, there are sudden restrictions regarding investing for retirement. Those restrictions are removed with self-directed Solo 401(k) retirement plans.

You have complete control over your investment vehicle. You can select the assets that you believe are appropriate for your portfolio because your retirement funds are under your control. This enables you to make investments by check. Custodian approval is not required.

6.Loans to Participants

Participant loans of up to $50,000, or 50% of your retirement account balance, are permitted in self-directed Solo 401(k) plans. Whichever is less. Furthermore, no one has any say over how you spend your money. You can use it to expand your business, purchase a new home, and so on.

7.Roth Savings Account

Roth contributions are permitted in self-directed Solo 401(k) plans. This allows you to contribute to your account after-tax dollars. In 2020, you had to contribute up to $26,000 (including catch-up contributions) to your Roth Solo 401(k). Furthermore, any earnings on investments in a Roth Solo 401(k) plan are tax-free. Assume you followed your plan and purchased a home. You then leased it for a consistent rental income and sold it for a significant profit. You keep the entire profit tax-free!

Covering your spouse under a solo 401(k) plan.

The IRS allows one exception to the no-employees rule on the solo 401(k): your spouse if they earn income from your business. That could effectively double the amount you can contribute as a family, depending on your income. Your spouse would make elective deferrals as your employee up to the $19,500 employee contribution limit (plus the 50-and-older catch-up provision, if applicable). As the employer, you can then make the plan’s profit-sharing contribution for your spouse of up to 25% of compensation.

Final Thoughts

You should consider a self-directed individual retirement account if you want to save for something other than your traditional retirement plan. It is intended for a sole proprietor, an LLC, or a corporation in Wyoming. Almost all financial institutions accept investments in the form of real estate, mutual funds, profit-sharing plans, stocks, bonds, and so on. Visit this recommended resource to learn much more about Solo & Self-Directed 401K LLCs.