How Credit Cards Help You To Get A High Credit Score?

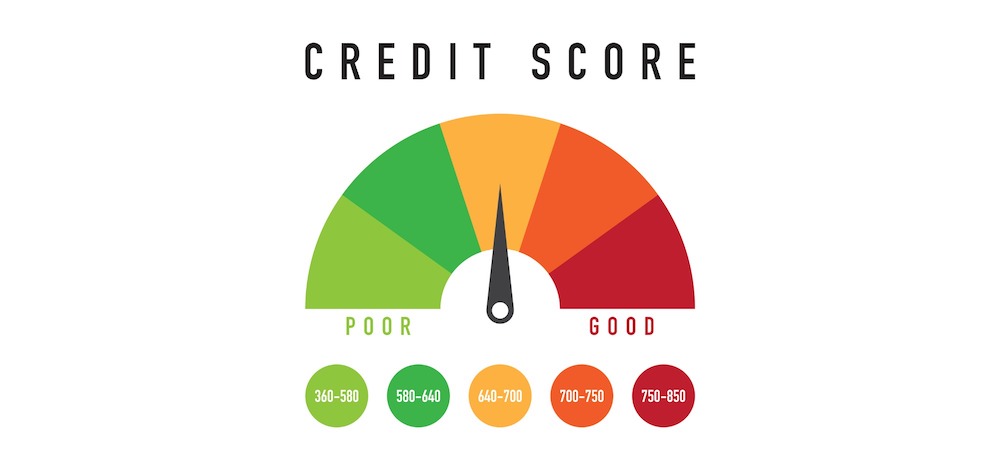

In the present age where your credit score is the most important thing to get a desirable job, a good loan on beneficial terms, or a favorite place to live in. You should consider good options that can make your credit score strong enough to meet these needs.

Whether you are building your credit score from scratch or trying to rebuild it, “Credit Cards” are one the best solutions to have. As these cards come up with high credit scores also save you from bankruptcy.

All you need to choose is the right card depending on your needs and show responsible behavior by paying monthly bills on time, keep your credit utilization below 30%, always seek for high credit-line, be an authorized user of your credit card, carefully fix your credit report errors, try not to sign up for multiple credit accounts and go for secured credit cards.

By fulfilling these requirements you can make your credit cards more effective and can repair your credit score swiftly.

After careful research, we have found some useful credit cards that can help you to build your credit history from scratch and be able to repair it. Also, get you a high credit score with unlimited cash rewards while enjoying low-interest rates.

Capital One Credit Cards

Capital One credit cards are well-known for every good reason. As they are able to satisfy people with any financial need. Also, they are known as “Fee Aversing” credit cards as there is no foreign transaction fee or no to low annual fee on almost every capital one credit card. They are so manageable while travelling abroad or doing online shopping.

With budget friendly offers or unlimited cashback rewards it’s really hard to choose the best suited Capital One credit card for your needs.

Capital One Platinum Credit Card

The Capital One Platinum credit card is a worthwhile option for those who have spotty credit history and can’t afford to have a low or average credit score. This card helps to build your credit history from scratch and rebuild it to have a high credit score.

Keeping in mind a fair credit score can’t get you an approval for any unsecured credit card. But Capital One Platinum credit card allows you to get a pre approval at www.getmyoffer.capitalone.com and enables you to build your creditworthiness.

Highlights:

- No annual fee

- No foreign transaction fee

- You can automatically considered for high credit-line in a short time period of 6 months

- Reports all the three major financial institutions

- You get an unlimited access to Credit-wise

Other Perks And Benefits:

Get Approved with Fair Credit Score

Whenever you apply for a new credit card your credit score gets hurt and also blows up your credit history. Thankfully, Capital One credit card offers a pre-approval tool to check your eligibility for the required card and you can apply for the best suited offers without hurting your credit score.

No plenty APR on late payments

Capital One Platinum credit card gives you an opportunity to select a date for monthly payments and choose the payment method that suits you whether to pay through pay check, online or at a local branch. In case of late payment Capital one Platinum credit card doesn’t put up your APR at all.

When you are adamant to have a low fee credit card with a fair or low credit score according to FICO score. Then a Capital One Platinum credit card is a smart option to have. If you get approved and use your card wisely by paying bills on time and keep your credit balance low. You can not only repair your credit history but can get a high credit score in as little as 6 months.

Merrick Bank Credit Cards

Merrick bank offers another range of credit cards that are purely designed for those having bad credit history or struggling to rebuild it. Unlike other credit cards they don’t limit your access to credit cards and offer you pre-approval opportunities with bad credit history.

Merrick credit cards don’t expose your less than perfect credit history to three major financial institutions, which helps you to build your credit history without hurting your current credit score.

Merrick Double Your Line Platinum Visa Credit Card

If you are looking for a chance to revamp your bad credit history without paying any security deposit then sign up for Merrick Double Your Line Platinum Credit Card. As this card aims to satisfy all with a good/fair/limited credit score. With on-time payments this card enables you to automatically double your credit line within the seven months after signing up for the account.

Highlights:

- No security deposit required

- Annual fee as low as $0

- Report all the three credit reporting agencies

- Get free FICO credit score each month

- After your account approval initial credit line ranges from $500-$1350 can be double to $1000-$2700

Other Perks And Benefits:

Pre-Qualification within 60 sec

Merrick Double Your Line Platinum Visa credit card is known as a savior for the people having bad credit scores. The applicants can see if they can pre-qualified for this card at www.doubleyourline.com within in a min without hurting their credit score. There is no hard inquiry or credit check for this pre-approval.

Visa Benefits with $0 Fraud Liability

This card also comes with full-fledged visa benefits users can enjoy all the Visa Platinum products and protections. There is a $0 fraud liability on unauthorized use. Also, no penalty APR on late payments. You can enjoy unlimited online access or auto-pay services with no hidden fees.

Merrick Double Your Line Platinum Visa credit card provides a positive base to build an excellent credit history. If you show responsible financial behavior it gives you an opportunity to double your credit line within a period of seven months. It is also a solid card to carry while travelling abroad.

Wrap Up:

Undoubtedly, credit cards are one of the best financial tools to build/rebuild bad credit history. Also, after getting approved for any best credit card you can get a high credit score within a year.

To make credit cards more effective you need to show responsible behavior by making on-time payments and keeping the credit utilization below 30%. If you want to see the other best alternatives moving around in the market hit at https://www.georgiabankandtrust.com/ as it will further satisfy your unanswered queries.