Consequences of Incorrect Medical Coding and Billing

Medical billing and coding play a big part in preserving the healthcare industry’s overall revenue cycle in good shape. Likewise, because it is a considerably more complicated process, experienced coders must stay up to speed whenever the relevant authority modifies and updates the codes. In healthcare institutions, precise medical coding outsourcing uses have a favorable impact on keeping and increasing overall revenue. Conversely, when healthcare providers have a good reputation, patients’ trust and experiences also improve.

However, if medical coders make mistakes during the claims filing process, they could suffer severe and minor penalties. On a lesser scale, the implications, such as claim delays, rejection, fines, and corrections from the government, result in failures in reimbursement. Larger-scale claim inaccuracy, on the other hand, entails dishonesty and fraud. Medical claim inaccuracies are regarded as fraud and are punishable by law. Experts point out that the prospect of closure these erroneous or faulty coding practices may produce may be more intimidating than fines and penalties.

In the following discussion, we have highlighted both the techniques that can reduce the risk of inaccurate medical coding services and billing and the specific devastating effects of such practices.

Penalties and Financial Losses

Healthcare providers may incur financial losses and fines due to inaccurate coding and billing. False claim submissions to the government can result in high fines and possibly jeopardize the financial stability of medical facilities. The Federal Civil False Claims Act (FCA) imposes harsh penalties and allows for the recovery of up to three times the government’s losses.

According to a 2018 American Medical Association (AMA) research, mistakes in medical invoicing cost physicians, on average, 7% of their annual earnings. These mistakes may result from incorrect coding, such as under-coding (not accurately capturing the scope of services delivered) or up-coding (assigning higher-cost codes to boost payments). Duplicate billing and service unbundling are further billing issues that can result in rejected claims, underpayments, or overpayments.

Legal Repercussions

Inaccurate billing and coding might have legal repercussions in addition to financial ones. The Federal Civil False Claims Act can lead to jail, degrade the reputations of healthcare practitioners, and undermine patient confidence.

For healthcare practitioners, inaccurate coding and billing might have legal repercussions. As an illustration, a hospital in Florida consented to pay $85 million to resolve claims of fraudulent billing and Stark Law violations involving physician referrals in 2018. A Texas-based healthcare organization, as another illustration, consented to pay $16 million in 2020 to satisfy False Claims Act claims, including false invoicing and up-coding.

Loss of Patient Trust and Reputation

When medical professionals are found guilty of medical abuse or fraud, the harm to their reputations is frequently irreparable. If this happens, a healthcare institution risks losing the patient trust necessary for its ongoing success. A decrease in patient volume and income may result from patients seeking care elsewhere.

For healthcare practitioners, inaccurate coding and invoicing can harm their reputation, impacting patient trust, referrals, and overall revenue. In a 2019 Kaiser Family Foundation study, 67% of participants expressed worries about unforeseen medical costs, and 40% said they had lost faith in their healthcare provider due to billing issues. The public image can be harmed by negative press coverage, legal repercussions, and word-of-mouth, which makes it more difficult for healthcare practitioners to draw in and keep patients.

Potential investigations and audits

Audits and investigations may be conducted on healthcare providers who use incorrect coding and billing practices. These can be expensive, time-consuming, and disruptive of daily activities. Additional financial penalties and legal repercussions may result from audits and inquiries.

Relationship Stress between Patients and Providers

Disputes between patients and healthcare professionals may result from incorrect invoicing and erroneous coding. When healthcare practitioners bill patients wrongly, they may feel irate and lose faith in them, harming the professional relationship and causing them to seek care elsewhere.

Effect on Healthcare Quality

By correcting inaccurate coding and billing problems, healthcare facilities risk diverting resources away from patient care and lowering the standard of care they offer. To solve these problems, providers can pay less attention to providing direct patient care.

For healthcare providers, inaccurate coding and invoicing can have serious repercussions. These errors may lead to monetary losses, legal issues, reputational damage, possible audits, and investigations, strained provider-patient relationships, and reduced quality of care. Healthcare providers should invest in employee training, put strict billing and coding procedures in place, and conduct routine audits to ensure compliance to reduce these risks.

Best Practices for Combating Wrong Billing and Wrong Coding

To overcome the difficulties posed by erroneous coding and billing in the healthcare industry, providers should establish best practices that support precise and effective operations.

Some methods healthcare organizations can employ are discussed to stop medical fraud, misuse, and the harmful effects of billing mistakes.

Spend money on staff education and training.

Staff members should get training and education on the most recent billing and coding guidelines and revisions. This minimizes the possibility of errors by ensuring the team is well-equipped to code precisely and bill claims.

Put in place reliable billing and coding procedures

Invest in cutting-edge billing and coding software that instantly identifies mistakes and discrepancies. This lowers the possibility of incorrect coding and invoicing by enabling healthcare providers to fix errors before submitting claims.

Conduct routine audits and compliance inspections.

Conduct routine internal audits and compliance checks to find potential coding and billing problems. The possibility of financial penalties and legal repercussions is reduced since healthcare providers can fix mistakes before they turn into more significant issues.

Create a system for precise documentation and record-keeping.

To preserve accurate patient records, use clear documentation and record-keeping procedures. This involves keeping documents organized and adequately stored, essential for guaranteeing precise billing and coding.

Keep lines of communication open with payers.

Open contact lines with insurance payers should be established to resolve any coding or billing errors promptly. This encourages collaboration and may assist in avoiding payment delays or rejections.

Outsource medical billing services

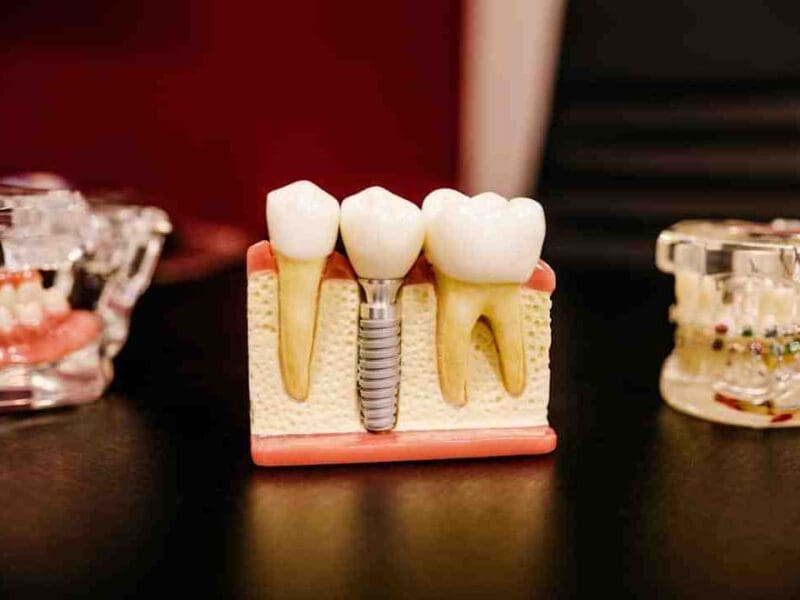

Outsourcing companies such as MedsDental dental billing company leverages the advanced technology and automation tools for medical coding. These tools help streamline the coding process, improve accuracy, and reduce the likelihood of manual errors. By using software and systems specifically designed for coding, outsourcing providers can enhance efficiency and accuracy in the coding task.

Promoting cooperation and teamwork

Encourage cooperation and cooperation amongst medical professionals, coders, and billers. This enables a more thorough approach to assuring accurate coding and billing and can help potential problems be found.

Use a patient-centered strategy.

Healthcare practitioners can prevent incorrect coding and billing by concentrating on the requirements of the patients. Make sure patients fully comprehend their invoices, respond to any inquiries, and take care of any issues. This encourages open communication and trust between patients and healthcare professionals.

Create processes for ongoing improvement.

Constantly assess and enhance coding and billing procedures. Simplifying the billing and coding process may entail investing in new technology, revising policies, or training professionals.

Healthcare practitioners can successfully deal with the problems posed by erroneous coding and invoicing by implementing these best practices. Doing this may encourage patient trust and improve the standard of care while reducing medical abuse, fraud, and financial penalties.

Conclusion

In healthcare, incorrect medical coding and billing can severely affect an industry’s financial health. These are the usual effects of legal implications, monetary loss, reputational harm, and strained patient-provider relationships. However, incorporating a few proactive measures will effectively guarantee the accuracy of medical coding and invoicing. Additionally, while effectively overcoming these obstacles, hospitals can cultivate beneficial relationships with their patients.