After the SPAC Rush, the Space Industry Moves On

The last two years saw a massive boom in SPACs (Special Purpose Acquisition Companies). This new chapter in the space industry saw the record numbers surpass even Initial Public Offers (IPOs). Its main trigger was the availability of vast amounts of money from private investors like venture capital firms.

However, there’s now the looming inevitability of a decline in the SPACs phenomenon. The leading cause of this is more requirements and investigations by the U.S. Securities and Exchange Commission (SEC). It’s no longer possible to raise easy capital using this means.

The space industry was getting used to SPACs because this made it simpler to take a company public. The SEC had fewer regulations for this, but the reality is different now.

Private and Public Capital to Boost Space Industry

Before grasping the SPACs decline, it’s better to know what it meant. That way, it becomes clearer why its decline is impacting the space industry and different companies.

Most SPAC companies are shells that aren’t necessarily involved in the space industry. A group of investors comes together to create one. Once a SPAC is up and running, they invest in a space tech company. That company dishes out units with a common stock share and guarantees the future ability to acquire more stocks.

Once the space tech company conducts an IPO, the units owned by a SPAC are registered. This is accomplished using the Form S-1 registration statement of the Securities Act. Later the SPAC begins its IPO process and goes public, which marks an acquisition.

The SPAC has up to 2 years to choose the company it seeks to acquire or form a merger. Then this is followed by the process to de-SPAC. Here, more funds might be necessary to attain its goal, which can cause dishing out of more shares or getting an issued debt.

One method of debt issuance is getting PIPE (Private Investment in Public Equity). After the merger is successful, the SPAC then falls under the SEC laws that are the only way to govern public firms.

The SPAC Craze of Last Year Is Coming to An End

The process was quite attractive to many in the space industry, leading to the SPAC rush. This saw more than 300 SPACs formed in 2021 alone to the tune of $100 billion. Such record listings were higher than those in 2020, with the space industry experiencing tremendous growth.

But then the SEC came into the picture with new guidelines about SPAC after several issues emerged. SPACs had many positives, but the negatives weren’t easy to ignore. For instance, a lapse in doing due diligence, which is a requirement before running an IPO.

The SPAC process is different and doesn’t necessitate a deep dive before moving forward with the process. Such an inadequacy leads to the omission of crucial information, which is a cause of concern for the SEC.

Another concern lies in safe-harbor statements. There’s a lack of transparency where this is concerned, as it’s not even available to IPOs. During the de-SPAC process, the financial projections don’t benefit from this, which was one of the attractions compared to IPOs.

The third issue lies in the issuance of warrants and their consequent accounting. Warrants give the owner the right to gain additional shares in the future at a specific price. But there’s a growing concern of SPACs not accounting for these warrants, yet still issuing conflicting financial statements.

Still, there’s the matter of government interest in the space industry and private sector. More government funding means the decline of SPACs isn’t as impactful as expected.

Governments Are Interested in Private Sector

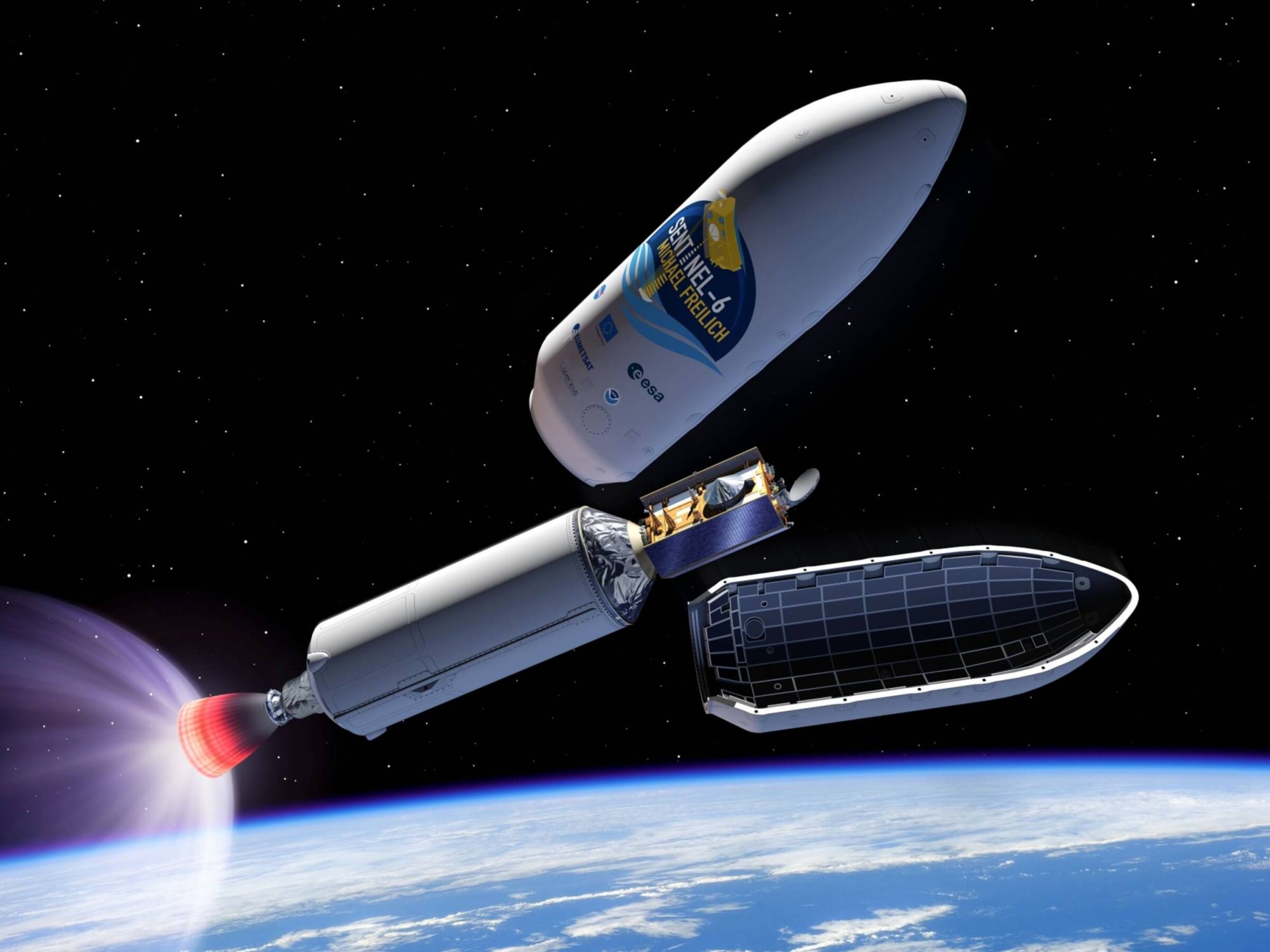

More governments are getting involved in the growing global space industry. This is mainly through space agencies as more countries come up with one. Blocs, e.g. the EU, have formed their own space bodies, e.g. – the European Space Agency (ESA).

The reality is SPACs are on the decline due to SEC tightening its laws. But this isn’t affecting the space industry as expected. SPAC investors will feel the brunt of this move, but the sector still benefits from immense government funding.

Therefore, the decline of SPACs doesn’t have as big a blow. The infrastructure and starting investment necessary to progress the sector come from governments. For instance, in 2020, governments injected more than $70 billion into the space industry. The private sector only contributed $9 billion, according to a special report by Euroconsult.

Governments are the number one client of the space sector, hence crucial to its growth. This makes such entities have a broader impact as clients and investors bring in more funds. Additionally, government funding comes with fewer issues that go against SEC laws or bring about new problems.

State Capital Still Remains the Primary Supporter for Commercial Space Companies

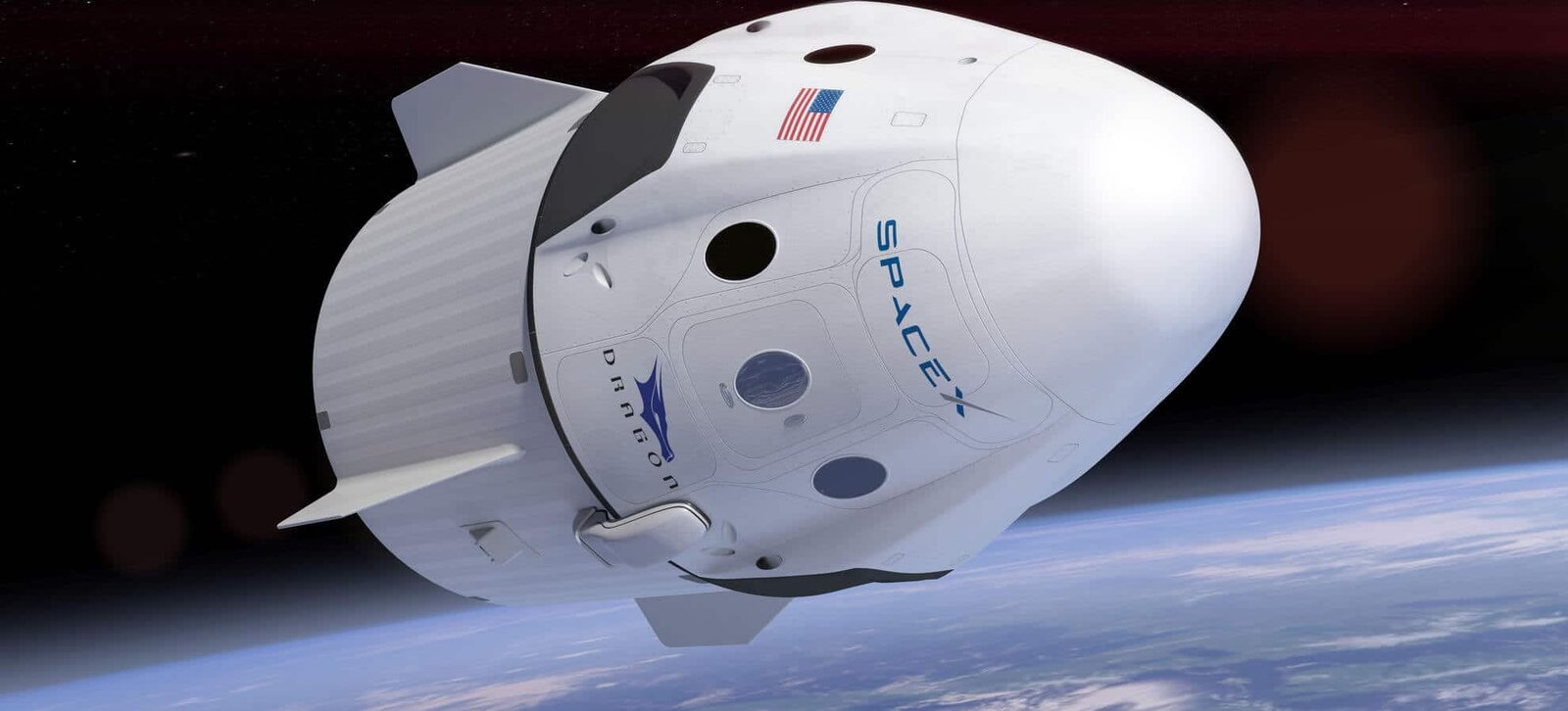

Most private space companies get a massive percentage of their funding from state agencies. Agencies like NASA and ESA have had a huge impact on private sector’s growth. This is either through direct financing or as customers of the private companies.

This is evidence of the crucial role state capital still plays in the growing space industry worldwide. Most private sectors can’t make it without this lifeline; hence, a continuing relationship from the first investment.

Government funding goes beyond making it possible to advance technology. One key area is the development of critical infrastructure like spaceports. An increase in the number of such launch sites directly benefits the private sector.

Most are set to increase satellite launches and space exploration missions. An increase in launch sites will see many achieve these visions on time. This is despite the decline of SPACs, which were a significant help for the sector.

In Summary

SPACs aren’t long-lasting, and many investors are feeling the impact of the decline. However, the space industry matches on due to the availability of state capital. While SPACs are attractive in many ways, it’s not easy to ignore several issues raised by SEC.