Factors That You Should Know Before Choosing Crypto Exchange for Trading

If you want to trade in cryptocurrency? Or do you want to capitalise on the advantages by using cryptocurrency as a payment method? Regardless of how you plan to use cryptocurrency, it is obvious that you would need the services of exchanges. Though this is a given, the platforms’ activities are governed by unwritten laws.

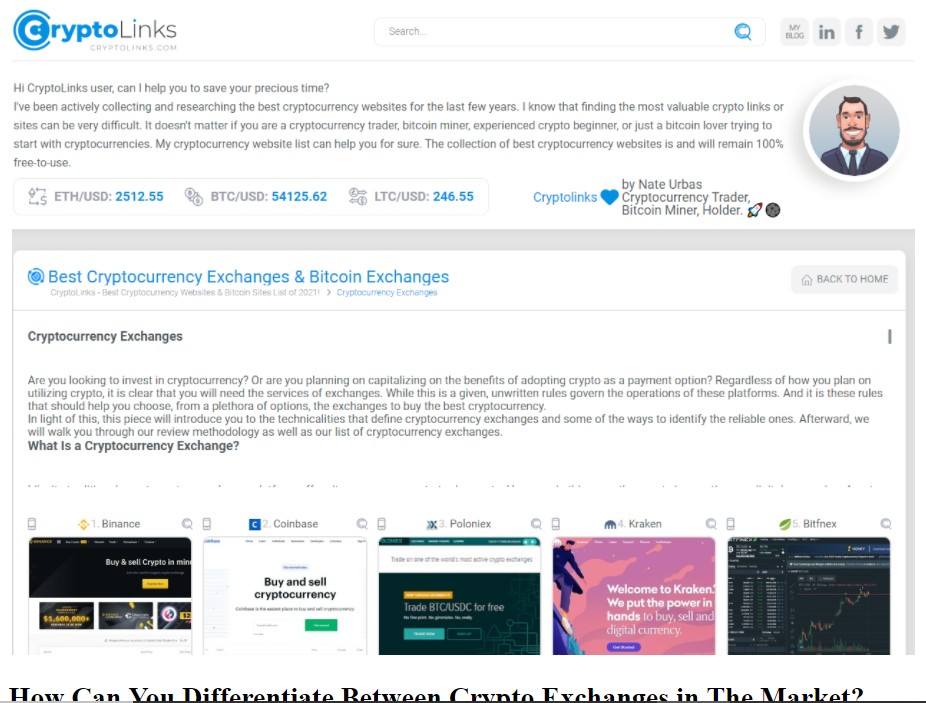

In view of this, this article will introduce you with the help of cryptolinks, technicalities that characterise cryptocurrency exchanges, as well as some methods for identifying trustworthy ones. Following that, we will go through our analysis process as well as our collection of cryptocurrency exchanges, so that you will be able to learn more about etoro.

What is Crypto Exchange?

A trading platform, like its standard equivalent, allows its users to share money. However, in this case, the goods in question are digital currencies. Aside from this fundamental functionality, exchanges are starting to use their increasing presence in the crypto sector to take on additional responsibilities. This claim is supported by the proliferation of Initial Exchange Offers (IEOs), which startups are rapidly using.

How Can You Differentiate Between Crypto Exchanges in The Market?

Although all cryptocurrency exchanges execute the same functions, but in subtly different ways, it is critical to understand the distinguishing factors that distinguish certain organizations and how they can be used in your study. These elements are as follows:

Governance Model of Exchange

Cryptocurrencies, such as bitcoin, introduced us to the benefits of decentralization as well as the drawbacks of authoritarian structures. As a result, it is unsurprising that the definition, which borders on sovereignty, has a position within the framework of the exchange sector. As a result, there are Dex-style decentralized coin exchanges. A bitcoin exchange in this category allows users control of their private keys. In essence, a shared market enables traders to communicate directly with one another.

Type of Trades the Platform Enables

The kind of trades that the market allows is the second differentiating factor of exchanges. The details to watch out for here are the exchange’s willingness to promote fiat-related trades. Any platforms provide customers with the ability to swap fiat currency and cryptocurrency trading pairs. In some terms, consumers will directly purchase crypto with fiat currencies or exchange crypto for fiat on the platforms.

Is Exchange Legal in Your Area?

You should have a good understanding of the legal status of cryptocurrency in your area by now. Countries with stringent legislative stances on crypto-related issues usually limit the operations of crypto exchanges. Cryptocurrency trading or transactions on exchanges can result in penalties for residents of those countries. As a result, before using exchange platforms, make sure that selling cryptocurrency is legal in your jurisdiction.

How Efficient is Exchange’s Customer Relation?

In the business world, a tradition of quality customer support has been the standard. In the trading industry, this idea has the same degree of efficacy since a platform’s client support community is one of the ways to measure its reputation. For starters, top cryptocurrency exchanges with internationally recognized brands must provide customer service that caters to a diverse group.

Does Exchange Support Advanced Trading?

Much as new entrants excel in simpler trading ecosystems, experienced traders’ profit from a trading site brimming with trading functionality and resources. They will welcome the ability to use advanced and customizable charting software. Experts must look into additional capabilities found in crypto trading infrastructures and ensuring that instruments suitable for dynamic research are usable not just on the platform’s online format but also on the smartphone app.

Does It Support Trading Volume and High Liquidity?

As previously said, centralized exchanges continue to rule the industry. This assertion is supported by the number of trades they process. Regardless of their scale, the biggest cryptocurrency exchanges in the room have the technology in place to fill orders. As a result, if immediate trading is what you want, big consolidated exchanges are the best option. Nonetheless, when selecting a trading site, liquidity, which is a little risky, falls into effect. It is good to choose a best crypto exchange with strong liquidity.

Is the Exchange Centralized or Decentralized?

As previously said, the governance paradigm of cryptocurrency trading networks is one of the key factors distinguishing these sites. On the one side, there are consolidated markets that have custody facilities, are subject to compliance conditions, and drive large market rate, among other things.

Security

When contrasting markets, security specifics of trading infrastructures are important. A careful examination of the recurring assaults on these sites reveals that exchanges could do more to maintain customer protection. As a result, two-factor authentication has become common procedure for cryptocurrency exchanges, providing their customers with an additional layer of protection.

How Much Exchange Charge on Each Trade?

It should be noted that cryptocurrency exchanges are free to set their own trading rates. However, for the sake of rivalry, the bulk of exchanges allow for low transaction fees. It is now up to you to compare the differences between two or more crypto exchange fee policies and choose the most appropriate.

If you’re at it, make sure the exchange offers subsidy frameworks for people who voluntarily participate in the industry. In certain situations, exchanges can subsidies taker payments if the number of transactions completed on the market reaches a certain threshold at the end of the month.

What Type of Payment Method is Available on the Exchange?

You can also look at the payment methods available on the exchange platform. This statement is valid for a cryptocurrency exchange that recognizes USD or other fiat currency. Depending on the exchange’s rules, you will have recourse to one or more payment methods, and the fees deducted on each account may differ.

For traders that choose exchanges that adopt conventional payment methods, it is critical to evaluate the payment processes as well as the policies that control them. The payment choices available, the minimum and maximum sum payable, the deposit fees, and the time it takes to verify payments are all details that might pique your curiosity.