A Beginner’s Guide to Shorting CFDs: How to Get Started

Are you interested in making money from falling markets? Shorting CFDs can be a great way to do just that. But if you’re new to the world of trading, it can seem daunting at first. Don’t worry – our beginner’s guide will walk you through everything you need to know to get started with shorting CFDs. From understanding what they are and how they work, to choosing a broker and managing your risk, we’ve got you covered. So grab a coffee, settle in, and let’s dive into the world of short selling!

Introduction to CFDs and Shorting

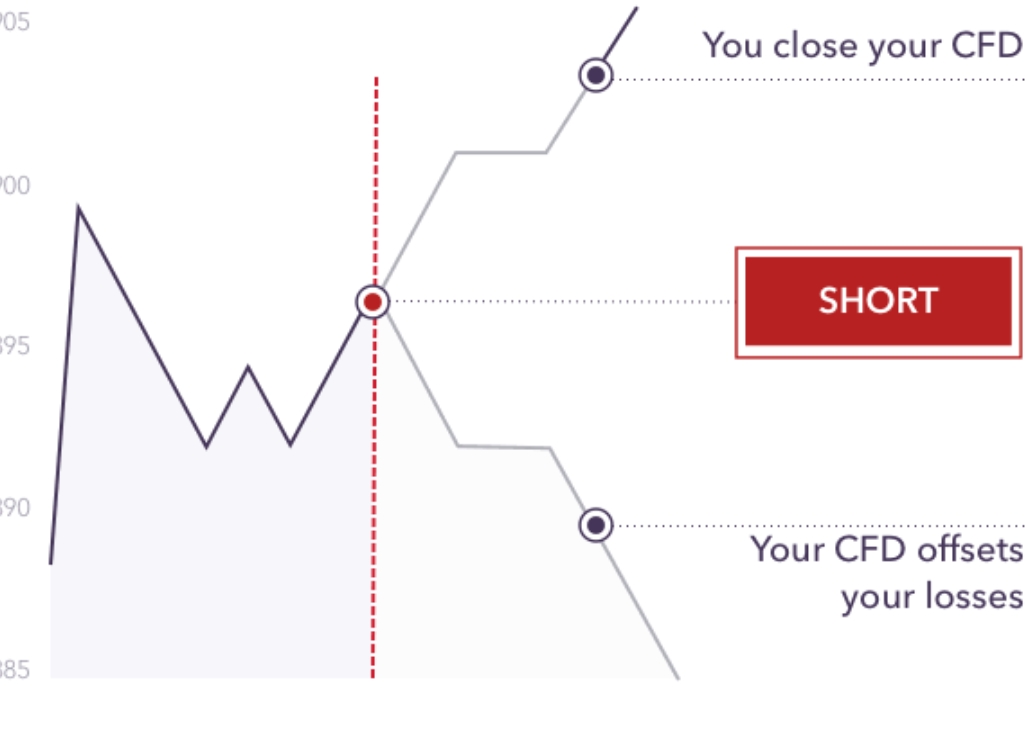

When you short a CFD, you are making a bet that the price of the underlying asset will go down. For example, if you think the price of gold is going to fall, you could short a gold CFD.

If the price of gold does fall, then your CFD trade will be profitable. You will make money for every point that gold falls. For example, if gold falls from $1200 to $1150, then your trade will be profitable by $50.

On the other hand, if the price of gold goes up instead of down, then your CFD trade will be unprofitable. You will lose money for every point that gold rises. For example, if gold rises from $1200 to $1250, then your trade will be unprofitable by $50.

When you short a CFD, you are essentially borrowing the underlying asset from your broker and selling it immediately in the hope that you can buy it back at a lower price so as to profit from the difference.

Advantagesof Shorting CFDs

When it comes to shorting CFDs, there are both advantages and disadvantages that you should be aware of before getting started. Some of the advantages include the fact that you can make money even if the markets are falling, and that you can take advantage of leverage to magnify your profits. However, there are also some disadvantages to consider, such as the fact that you could lose more money than you invested if the markets move against you, and that you may have to pay financing costs if you hold your position for a prolonged period of time.

When it comes to CFD trading, one of the main advantages of shorting is that you can profit from falling markets as well as rising markets. This is because when you short a CFD, you are effectively selling it in the hope that you can buy it back at a lower price so that you can make a profit.

How Does Shorting CFDs Work?

When you short a CFD, you are selling the underlying asset in the contract at the current market price. You are then hoping to buy the asset back at a lower price so that you can profit from the difference.

To do this, you first need to open a short position with your broker. This is done by selecting the asset you want to short and specifying the amount you wish to trade. Your broker will then sell the asset on your behalf and credit your account with the proceeds.

You will then need to wait for the price of the asset to fall before buying it back and closing your position. If the price falls as anticipated, you will make a profit equal to the difference between the prices at which you sold and bought the asset. However, if the price rises instead of falling, you will incur a loss.

Calculating Profits and Losses When Trading CFDs

If you’re thinking about shorting a CFD, one of the first things you need to understand is how to calculate your potential profits and losses. Fortunately, it’s not too complicated – but there are a few things you need to keep in mind.

When you open a short position on a CFD, you’ll be required to put up what’s called a margin. This is essentially a deposit that will be used to cover any losses that you may incur. The amount of margin required will vary depending on the broker, but it’s typically around 10-20% of the value of the trade.

So, for example, let’s say you want to short a CFD with a value of $100. If the margin requirement is 20%, that means you’ll need to put up $20 as collateral. If the price of the CFD falls by 10%, your trade will be closed automatically and you’ll lose your entire margin (in this case, $20). On the other hand, if the price falls by 20%, you’ll make a profit of $20 (minus any fees charged by your broker).

It’s important to remember that your potential losses are not limited to your margin – if the price of the CFD continues to fall, you may be required to put up more money to keep your position open. In some cases, brokers may even force traders to close their positions if they reach certain levels of loss. So always make sure you understand

Tips for Beginner Traders When Shorting CFDs

When shorting a CFD, the first thing to remember is that you are selling a contract, not an actual asset. This means that you are speculating on the future direction of the underlying asset’s price.

If the price of the underlying asset falls, you will make a profit; if it rises, you will make a loss.

It is important to remember that your profit or loss will be based on the full value of the contract, not just the difference in price. This means that your losses can be much greater than your initial investment.

Here are some tips to help you get started when shorting CFDs:

-Start with small contracts: When you are first starting out, it is best to trade small contracts so that you can get a feel for how the market works and how to place orders.

-Set stop-losses: A stop-loss order is an order placed with your broker to sell a contract if it reaches a certain price. This will help limit your losses if the market moves against you.

-Monitor your positions: It is important to keep an eye on your open positions and adjust your stop-losses as needed.

Conclusion

Shorting CFDs can be a great way to make profits from market fluctuations. It does come with risks, however, so it is important that you understand how the markets work and have an understanding of risk management strategies before getting started. By following this beginner’s guide to shorting CFDs, you should now have the knowledge and confidence needed to start trading with success. With practice and patience, you can soon become a master of this powerful investment tool. If you need any other information please visit this website.