Benefits of debit cards for your business +

A debit card is a payment card linked to your bank account. You first deposit funds into the account and then use the card to use them at your discretion – to pay for purchases at retail outlets or online or to withdraw cash from ATMs. Many users confuse debit and prepaid cards. The latter is not linked to a bank account. A prepaid cardholder uses money deposited into a particular card account in advance. Once the money is used from that account, it is only possible to use the card once a new deposit is made.

Thanks to today’s bank card platforms, any company can launch a card program for their business. It can be a co-branding program or a European private-label debit card program. The White-Label solution allows companies to issue cards with corporate logos. It makes a company more competitive and increases its brand awareness.

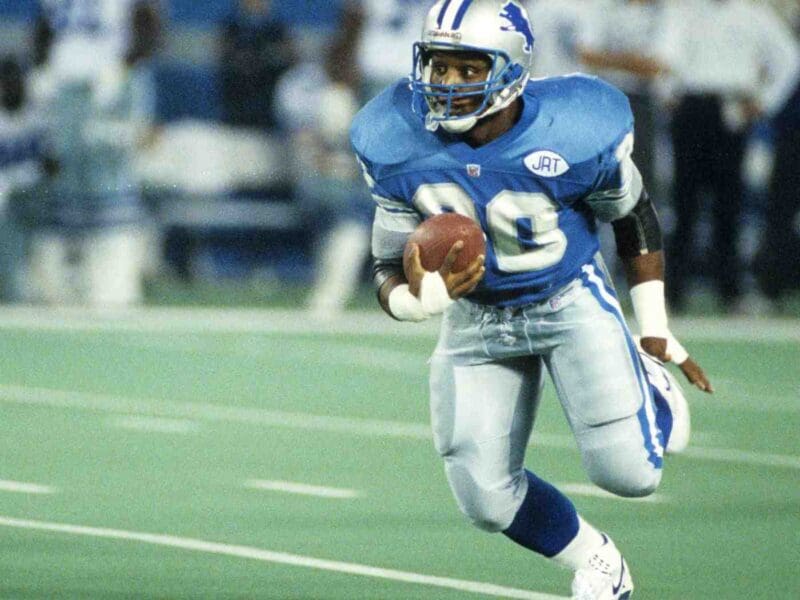

Debit cards for business

Launching your debit card program has a lot of undeniable advantages for your business. Let’s write about each benefit in more detail.

Easy to set up

Using a particular platform to run a card debit program launches much faster than traditional banking products. The off-the-shelf software integrates easily with the company’s existing software and requires no additional fine-tuning, searching for developers, or additional partnerships.

Extra income

The company launching the card debit program sets its fees for using it. Fees may be set for the following services:

- ATM cash withdrawals;

- card issue/reissue;

- payment for goods and services.

The debit card can become an additional source of income for the company.

Easy setup

The debit card program can be customized to the needs of your business. Not only can you customize commissions and rewards, but also, thanks to the White-Label solution, you can create an exclusive design of the card and the mobile app. Thanks to the individual design, you can visualize the brand’s central idea on the payment tool and increase its recognizability.

Loyalty programs

When you launch your debit card program, you can offer your clients various loyalty programs. It could be a system of accumulating bonuses or points for using a debit card. Each card has its identifier, so it will be easy for you to track your clients’ spending, analyze it and create more favorable conditions for loyalty programs, up to individual offers for each user.

High security

The bigger the company, the more cards it issues and the more transactions and information it needs to process, store and transmit. It’s critical to ensure security for all of this data. The most secure cards are those that support the PCI DSS security standard.

PCI DSS is a standard developed by the Payment Card Industry Data Security Standards Council. It defines requirements for storing, processing, and transmitting payment card data and helps protect the cardholder and the merchant. This standard requires the deployment of a firewall, mandatory data encryption, anti-virus software, and other conditions to ensure the security of debit card payments.

Time Savings

The software for debit card issuance is at the company’s disposal, so there is no need to spend time getting a license and launching the card product. Both physical and virtual debit cards are issued equally quickly using a particular platform. They can be used to pay for goods and services at retail outlets and online.

Debit cards are a multifunctional and reliable payment instrument that makes financial operations simple and convenient. For businesses, it is an additional opportunity to control their expenses, generate additional income, and strengthen customer relationships.