Bitcoin – A Weekly Update With Technical Analysis

This year was very ruthless for Bitcoin because it has continuously seen a fall in price. As we begin the last period of 2021, it is essential to take a quick look at Bitcoin’s record price in November. November has gone through similar advantages and drawbacks for Bitcoin. The figure was at the lowest in the commencement but remained at the superior position from the other cryptocurrency. While in the midsection of November, the price again fluctuated and changed by a tiny percentage.

However, the best alteration in the price of cryptocurrency Bitcoin was seen by the end of November. As of 29 November 2021, BTC fell by 2.30% and ended up at $57357. On Monday, a mixed start was quite visible as the prices hiked by$2124 before falling back in reserve. Significant resistance in the price of Bitcoin slid by the end of Friday to the lowest.

Last Week Third Day Report

It was pretty frustrating to see the red day of Bitcoin as the price was constantly falling towards the down. However, when the price fell, the sales margin was relatively high on Friday, with approximately 9% then the actual sale trading.

Last Week 4th Day Report

A green signal was seen where the damage to the Bitcoin was very little compared to the other days. An increase in the price and the trading rates were pretty good. However, it is essential to mention that Bitcoin went up by 0.65 %, a mixed result. On the opposite side, there has been a quick discussion over the famous cryptocurrency ethereum. The record-breaking fall in the percentage of ethereum last week, which ended up at $4297. It is the second cryptocurrency giving tough competition to Bitcoin; however, the price is comparatively way less.

Although the second most incredible digital money is also facing fluctuation and percentage reduction in the market value, as for the future focus, there will be more decrease in the value in the upcoming days in ethereum. Therefore, the cryptocurrency needs to maintain the percentage and Goodwill in the market by taking the support of investors. Besides, Bitcoin will have a better future and a good market value by the end of December.

Next Week Forecast Report

It has been considered that with the ongoing decrease in the price of Bitcoin, the need for a broader market will be more appreciated.

Bitcoin would avoid pivoting to come back to the same position and increase the value of the share as it is imperative to do so to maintain the position.

The great financial analyst has analysed that December 2021 would be an excellent month for the Bitcoin market. However, Bitcoin is not losing hope in increasing the price value by involving millions of traders.

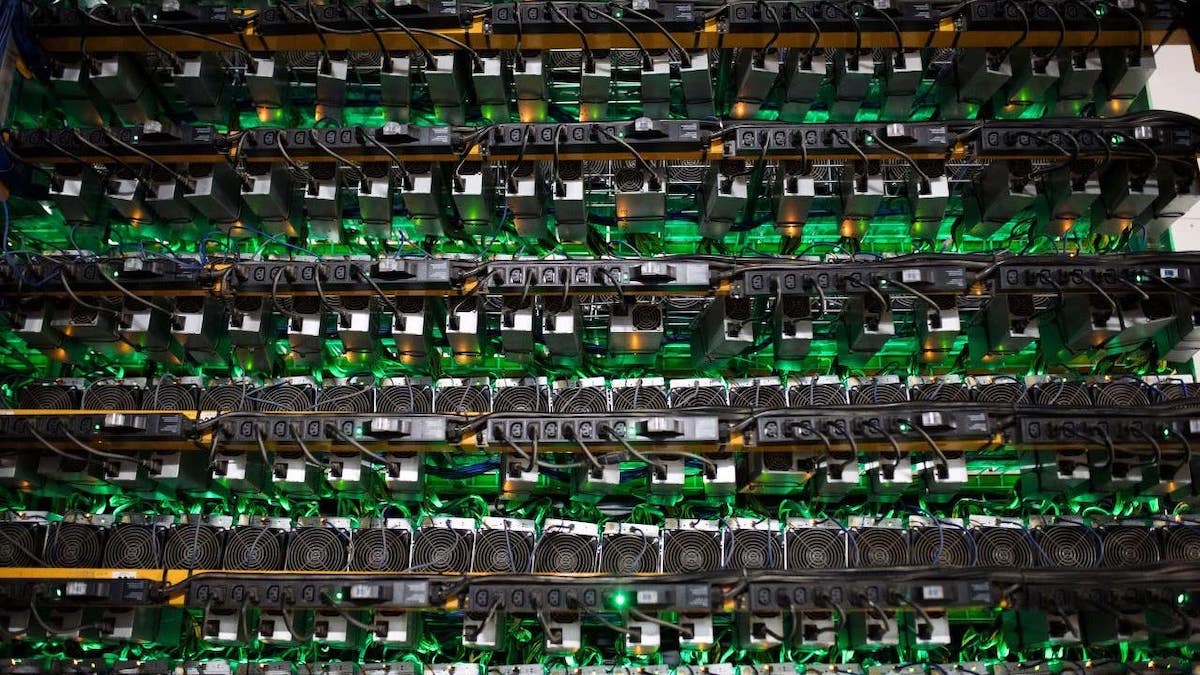

The progress in Bitcoin mining is noticeable and more people are connected to solve the cryptography to increase the mining process.

What Can The New Investors Expect From Bitcoin?

As per the recent theory of Bitcoin, it is pretty exciting to know that Bitcoin mining and security is working tremendously high to increase the value. Therefore, the new investor might obtain more genuine opportunities and value shares. However, the current investors must be more patient with the shares and keep them for future exchange.

No investor should change their mind because of fluctuation in the price and decrease with a certain percentage. It is essential to know that Bitcoin is a volatile cryptocurrency, and the price keeps on changing with demand and supply. New investors should look for different ways where they can invest the money and generate more Bitcoin. Bitcoin is a digital asset and the need of the future, and it is vital to understand the terminology and use your information in the right course.

The new investor can expect to connect with the Bitcoin users and gain more knowledge related to mining and trading. There are a few critical features that require the immediate attention of every individual who is coming to the floor for the very prime time. In the meantime, the investors can add these attributes and become friendly with them to exercise control in the future.