eToro: A comprehensive review

If you are one of those people who wants to know about eToro then you are on the right place. In this review we are going to wrap up all the necessary things about eToro. Or this eToro review is a comprehensive guide for you all.

About eToro:

eToro is a famous fintech Israeli company and as well as a social trading broker. It is established in the year of 2007. This Israeli company serves the clients of United Kingdom via a specific unit which is operated by the Financial Conduct Authority (FCA) and Australians via an Australian Securities and Investment Commission (ASIC), and the rest of the clients are served by a Cypriot unit that is operated by the Cyprus Securities and Exchange Commission (CYSEC).

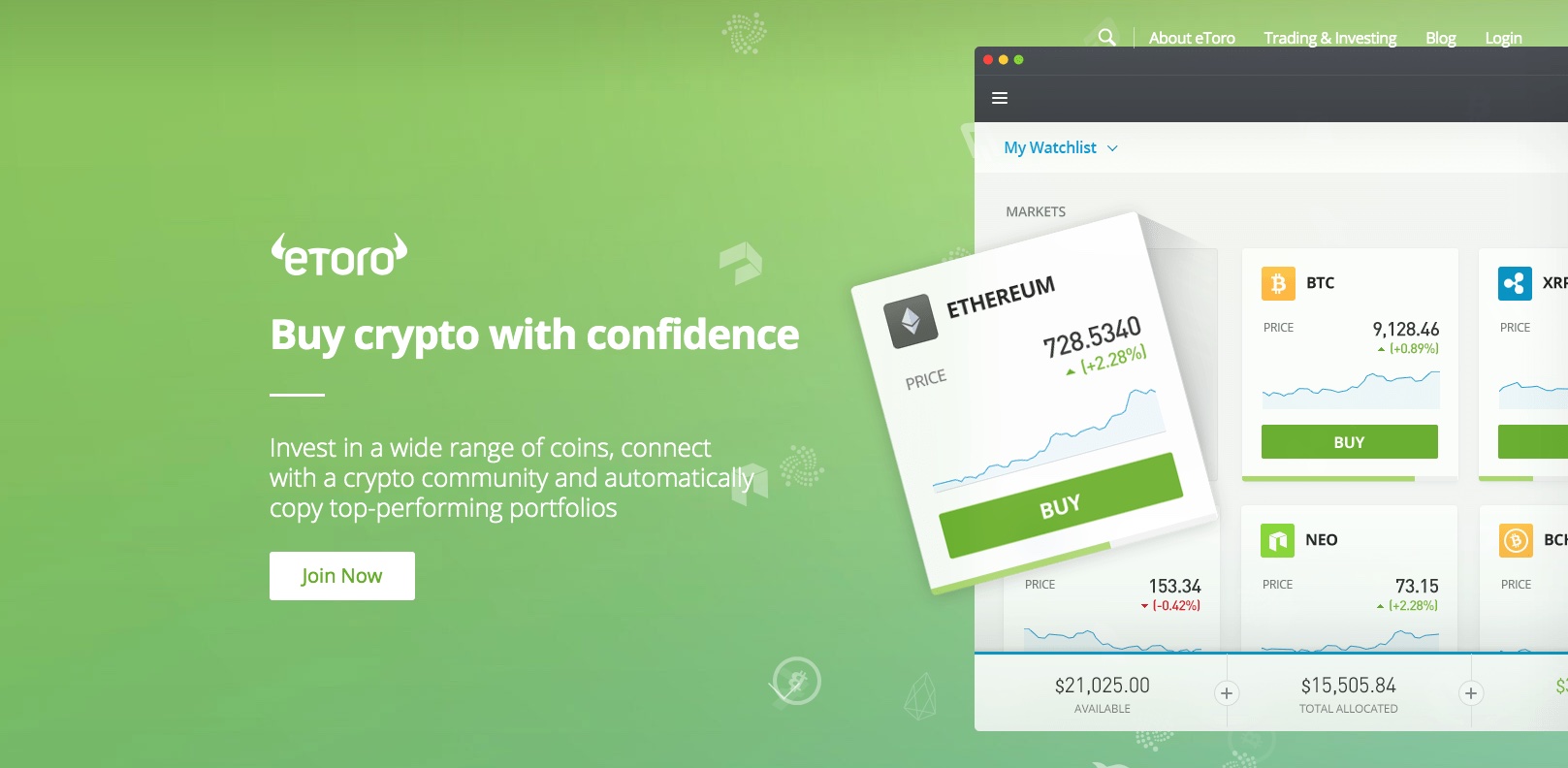

What eToro offers???

This is the most asked question that what eToro offers. So, for all those who are new in this field take a look below and soon you will get to know.

Basically, eToro provides commission free stock trading and as well as the process of account opening. This account opening process is seamless and fast. It has numerous new features as well for their beloved customers. Such as social trading, which can provide you to copy the techniques of the other traders.

Advantages of etoro:

eToro offers following advantages:

1) eToro offers free of cost stock and ETF trading.

2) eToro offers seamless account opening.

3) The best thing about eToro is it’s offer social trading.

Disadvantages of etoro:

Everything which is present on earth has a positive and negative side too. Just like the same way eToro has few disadvantages too. The non trading fee of eToro are so expensive. Even though they are having fees for withdrawal and inactivity too. The prices of withdrawal is quite slow and the only currency you could hold your cash in is United States Dollars. Take a look below and find what are disadvantages of eToro.

1) It is daunting to contact the customer support of eToro.

2) The non trading fee of eToro is too much high that a common man fail to afford.

3) Only in one currency you can hold you cash.

The trading fee of eToro:

As we all know that it is so difficult to compare the trading fees for the brokers of CFD. Here the question arise is how did we dig into the issue in order to making their fee comparable and clear?? So, we compare all the brokers by calculating the fee of a specific trade for the specific products. For this we selected famous instruments within every single asset class:

1) Stock index CFDs: EUSTX50 and SPX

2) Stock CFDs: Vodafone and Apple

3) Forex: GBPUSD, EURUSD, AUDUSD, EURGBP and EURCHF.

Non trading fee of eToro:

As we all know that eToro has high non trading fee. It charges 10 dollars every month after inactivity of one year. Yet, simply logging into the account counts as an activity. There is also a 5 dollars fee in every withdrawal.

Minimum deposit on eToro:

What minimum deposit I supposed to keep at my eToro??? The majorly of people asked this question. Well the answer is the minimum required eToro deposit is 200 dollars. As a statistical analysis which was held on the month of February in the year of 2021 while a period of volatile market, eToro is increased the requirements of its minimum deposit. But it was back to the normal to the last level on the month of March in the year of 2021.

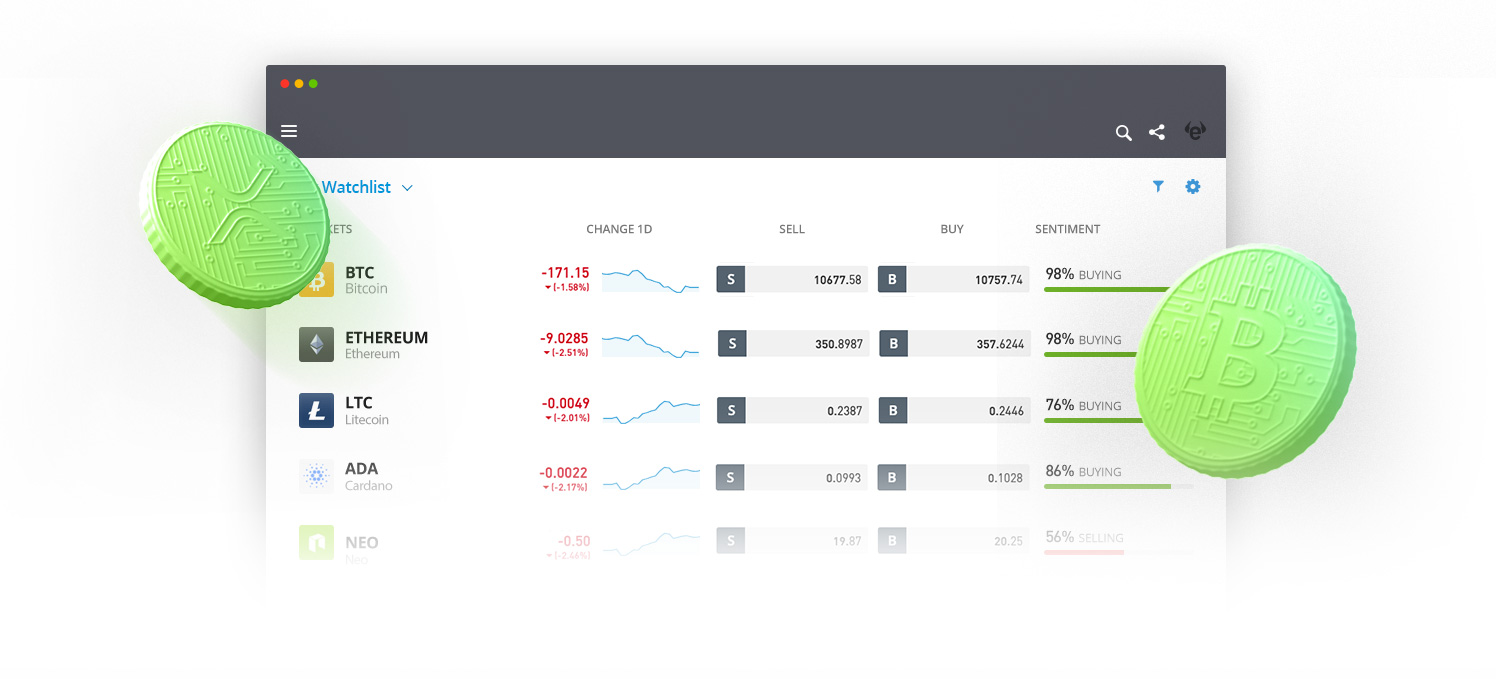

Charting of etoro:

The charting of eToro is best and you can easily able to use various. It is noticed that almost 70 technical indicators anyone can use without any difficulty. The best thing is people liked that the charts are saved automically. So it means you do not have to waste your time to setting up the time of your indicators again and again.